How to make money with cryptocurrency in 2024

With growing popularity of cryptocurrency, more and more people are beginning to consider it as a way to earn money. Over the past few years, cryptocurrency has become a massive phenomenon that has changed people’s ideas about economics and finance. And since digital assets are already part of our reality, other ways to make money on cryptocurrency have appeared in addition to ordinary trading. Next, we will consider them in more detail.

TOP 10 best ways to make money with cryptocurrency in 2024

The top best ways to make money on cryptocurrency include: trading, farming, mining, staking, earning on games, p2p, on NFT, landing, copy trading, investments in crypto projects, etc.

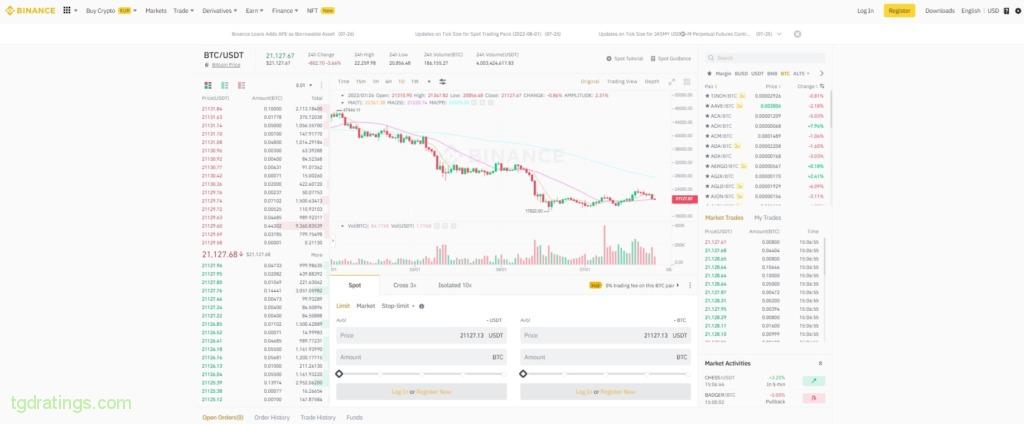

Exchange trading

Cryptocurrency trading means buying and selling digital assets (tokens, coins, NFTs). Trading involves active actions in the financial markets, while investing works according to the “buy and hold” strategy.

Experienced traders rely on well thought out methods and strategies to successfully trade the market. Despite the volatility of cryptocurrency prices, traders tend to follow certain patterns, i.e. take a strategic approach to trading.

Cryptocurrency trading strategy is a fixed plan of action for making a profit when buying or selling in the cryptocurrency markets. Trading strategies usually determine what trades to take and when, when to exit of them, and how much capital allowed to risk with on each position.

A few common investment strategies are:

- Scalping is a trading strategy in which traders (known as scalpers) seek to profit from relatively small price changes. Scalpers open and close a large number of trades in one trading day in order to get a lot of small winnings;

- Day trading: a lot of traders think that day trading and scalping are similar. Although both styles of trading take place within the same trading day, there are significant differences. Intraday traders open and close significantly fewer setups compared to scalpers. Sometimes one setup per day is opened, and often no more than a pair per trading day. An intraday trader usually holds a trade for several hours, but no more than one full trading day;

- Swing trading: it is a strategy whereby traders enter and exit the market periodically, holding trades for days or weeks. Swing traders often use relatively lower levels of leverage, although this is not mandatory. They tend to use a mixture of fundamental and technical analysis, aim for higher price targets, wait while a trade develops. In most cases, a trading setup does not close within one day;

- Market arbitrage refers to buying and selling the same coin in different markets at the same time to take advantage of the price gap between those markets. By definition, arbitrage is the manipulation of price differences in different locations for the same asset to obtain a risk-free profit. For example, you can buy cryptocurrency on Binance and sell it on OKX.

Recommended exchanges for making money on cryptocurrency

Cryptocurrency trading takes place on crypto exchanges – trading platforms that provide fast exchange, security and high liquidity. The top platforms for trading digital assets are listed below.

Investing in cryptocurrencies

Investing in cryptocurrencies always involves risk. After a few months or years, the asset may be sold on price much higher than the purchase one, or may lose its value. Well-established cryptocurrencies such as Bitcoin, Ethereum and Litecoin rise and fall daily. New coins like Chia are more likely to debut at a higher price due to the hype.

Before deciding which cryptocurrency to use as a long-term investment, it is important to read the project white paper. This will give a clear idea of the origin and purpose the project serves, and let you know if the project will stand the test of time.

Best new tokens with potential in 2024

Dozens and even hundreds of new cryptocurrencies enter the market every day. The reality is that most of them will never become valuable. So there is a question what is the best new cryptocurrency to buy in 2024 year and what digital coin has the highest probability of growth in the future? There are new cryptocurrencies with growth potential that can be bought today below:

- Position Exchange;

- Lunar;

- Goldfinch;

- Zebec Protocol;

- ZooKeeper.

HODL

HODL is a misspelling of “hold” and a popular term used in the cryptocurrency world to describe a particular investment strategy.

HODL is an investment strategy where users buy cryptocurrencies and hold them for a long period of time. This allows investors to take advantage of the increase in the value of the asset. A HODL strategist is not trying to time the market and is not going to sell his investment when the market might fall.

The opposite of HODL is the short-term investment strategy. In this case, investors buy when prices are low, hold the asset while its value rises, and then try to sell it before the price falls.

Cryptocurrency staking

Cryptocurrency staking is the process of locking crypto assets to maintain the blockchain network and validate transactions in order to receive rewards. Staking is available for cryptocurrencies that use the Proof of Stake (PoS) consensus mechanism. This is a more energy efficient alternative to the (Proof of Work) model.

Staking rewards are the incentive that blockchains provide to participants. Each blockchain has a certain amount of crypto rewards for validating a block of transactions. When you stake cryptocurrencies and you are selected to verify transactions, you receive a reward.

Benefits of staking cryptocurrency:

- An easy way to earn interest on cryptocurrency;

- No hardware needed, unlike mining;

- Supporting blockchain security and efficiency;

- Staking is more environmentally friendly than mining.

Mining

Mining is an important part of the Proof of Work (PoW) consensus mechanism and one of the oldest ways to make money with cryptocurrencies. It is the process of verifying transactions and securing the network. To perform these functions, miners receive new coins as a block making reward. In the early days, bitcoin mining was possible on a usual PC, but today it requires specialized hardware, such as ASIC or industrial mining farms.

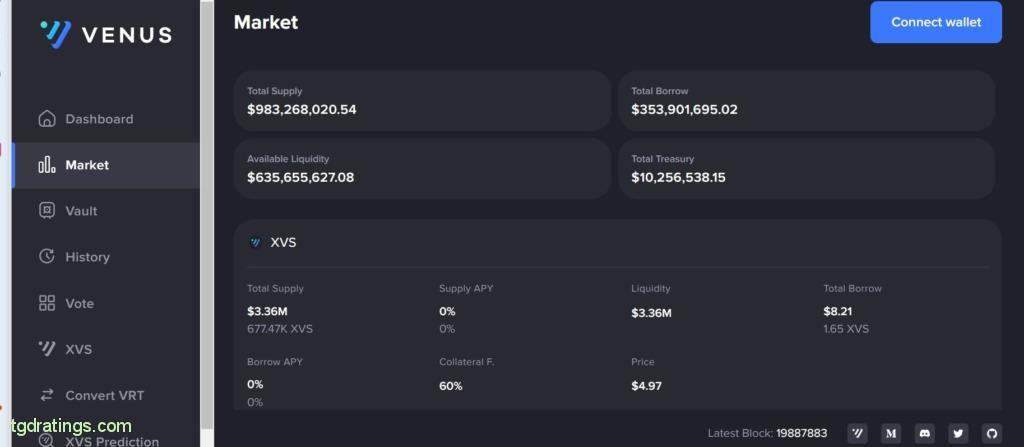

Farming

Farming is a popular way to earn rewards for providing liquidity to DeFi services.

Income is made up of two components:

- Shares of trading commissions for buying and selling assets in this pool;

- Rewards for providing liquidity paid in Exchange Governance Tokens.

Let’s take a closer look at how farming works. It all starts with DeFi (decentralized finance) platforms. These projects require a large amount of cryptocurrencies to increase liquidity, but usually do not have enough funds. This is why DeFi offers high interest rates in exchange for user coins. The coins are collected in a liquidity pool and used by the platform for lending, borrowing and trading.

Crypto games

Games use “play to earn” model involve rewarding participants with digital money or non-fungible tokens (NFTs). In recent years, these games, also known as P2E, have become mainstream and a major component of the Metaverse. These platforms have their own form of cryptocurrency to pay online gamers for their time.

Earning currency of real value while having fun is one of the main reasons Pay-to-Earn (“play to earn”) games have become so popular. Some of the most popular P2E games include:

- Axie Infinity;

- Decentraland;

- Alien Worlds;

- The Sandbox;

- Zed Run;

- Blancos Block Party;

- Gods Unchained;

- My DeFi Pet;

- Star Atlas;

- CryptoBlades.

Cryptocurrency lending

Crypto investors who plan to HODL their crypto assets and do not plan to sell any time soon, can borrow cryptocurrencies and earn interest for this period. Many exchanges provide services for generating passive income through lending. For example, the exchange Binance offers 2 types of deposits: with fixed rate and with floating rate. The annual yield depends on the coin and is about 25% per annum. Gate.io allows you to lend and borrow 200+ assets, set interest bet, etc.

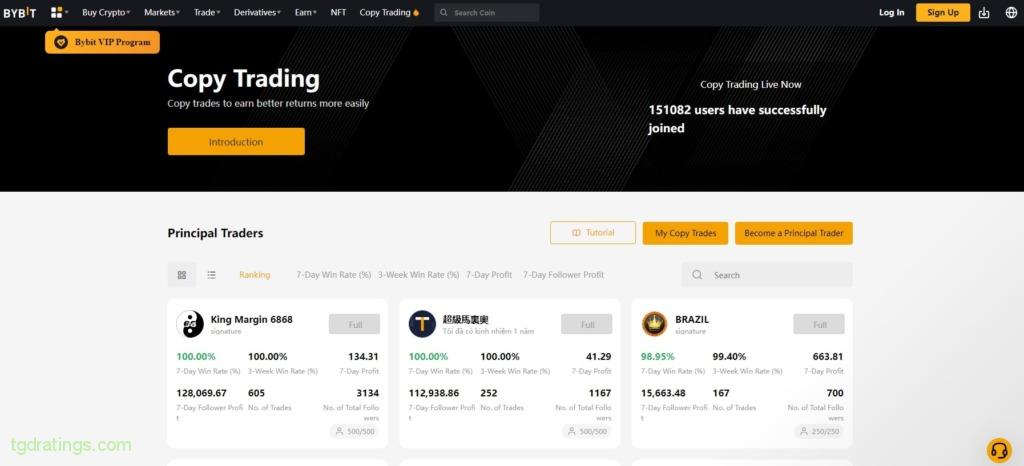

Copytrading

Copytrading allows less experienced traders to copy the trades of more experienced traders. Copy trading is one of the easiest ways to leverage the expertise of another trader. You still have the ability to close deals and open new ones whenever you want. By copying another trader, you can potentially make money based on their skills. Participation does not require any additional knowledge of the financial market.

There are no special commissions for using the copy trades feature but you have to pay the strategy manager whenever they make a profit. Any brokerage fees that apply to a regular trade will apply to copy trades.

Investments in companies and crypto projects

Cryptocurrency launchpads are platforms that serve to host various blockchain and cryptocurrency based initiatives. Such platforms provide opportunities for earning, and also give investors the benefits of early access to promising assets.

There are different methods that crypto projects can use to connect with clients and raise funds below:

- Initial Coin Offering (ICO) is a type of financing for a project or startup, which is carried out by issuing coins (or tokens). Tokens are purchased by participants (investors) in exchange for an acceptable payment instrument (such as fiat currency) or cryptocurrencies such as Bitcoin or Ethereum. The value of these tokens depends on the viability of the project and may significantly increase later;

- Initial Exchange Offering (IEO) is a fundraising event managed by an exchange. Unlike ICO, when the project team conducts its own fundraising, in IEO fundraising is carried out on a fundraising platform of a well-known exchange, such as Binance Launchpad or Huobi Prime where users can buy tokens directly form exchange;

- Initial DEX Offering (IDO) refers to the initial release of coins on the Decentralized Exchange (DEX). The IDO initiative was first proposed by the Raven Protocol project team;

- Security Token Offerings (STO) is essentially a crowdfunding token offering. Tokens can be backed by company assets (e.g. shares), right to receive dividends or voting rights. The security token allows its owner to vote and is regulated by the U.S. Securities and Exchange Commission (SEC). This limits the circle of potential investors who are eligible to invest into the project.

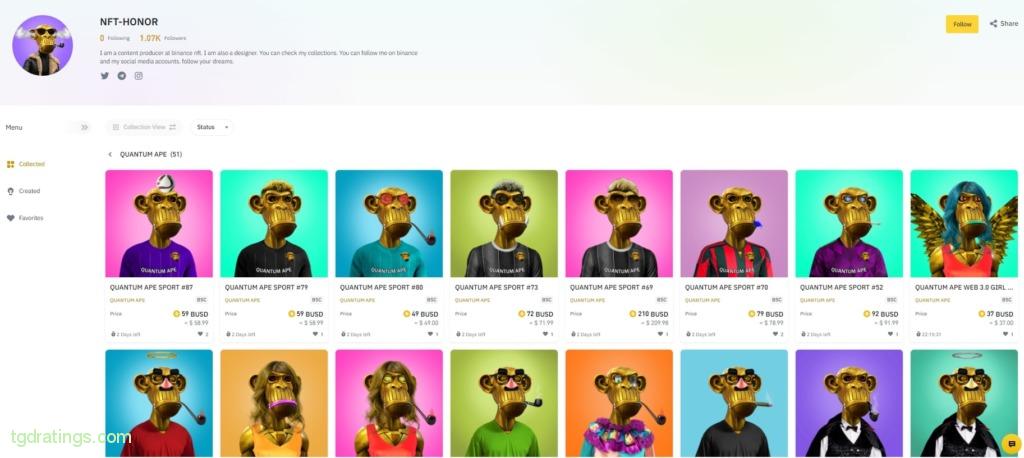

Metaverses and earnings on NFT

In addition to directly selling NFTs, you can earn passive income in other ways:

- NFT staking: receiving rewards for staking tokens, while retaining ownership of them. Staking NFTs can be a good strategy if you plan on holding them for the long term as they cannot be sold at this time. NFT staking platforms take NFT rarity into account when calculating APY (percentage annualized return). The higher the rarity, the higher the APY and the staking reward. There are currently several platforms that support NFT staking, including Kira Network, NFTX, Axie Infinity and others;

- Rental of collectibles: Some GameFi platforms allow passive NFT income by renting digital collectibles to players. You can rent items such as character skins, innovative weapons, and unique tools that unlock new game features. For example, reNFT is a protocol that allows NFT assets to be leased;

- Receiving royalties from NFTs: Token creators seek to make a profit by bringing their digital artwork to market. They are paid royalties when their NFT is traded on the secondary market. Thus, you can receive percentage from NFT sales for an unlimited period;

- Providing Liquidity with NFTs: The current integration of NFTs into the DeFi ecosystem allows you to provide liquidity in DeFi pools and earn a return for NFTs. For example, when a user provides liquidity to the Uniswap V3 decentralized exchange, they are given LP-NFT and ERC-721 tokens instead of the amount they have locked in the pool. You can sell this NFT on the secondary market to liquidate your position in the liquidity pool.

Earnings on cryptocurrency without investments

In addition to paid ways to get cryptocurrency, there is an opportunity to earn it without investments. However, it takes quite a lot of time, and the amount of earnings is not high. There are the main ways to earn money on cryptocurrency without investments below:

- Exchange Signup Bonus: Many crypto exchanges offer a cryptocurrency bonus if you sign up as a customer. Some of the exchanges offering free cryptocurrency are: Coinbase, Gemini, Crypto.com. From time to time, exchanges add promotions or provide term bonuses in the form of cryptocurrency;

- Bounty programs: Another way to earn cryptocurrency is to participate in bounty programms. A bounty is a crypto reward that is offered to anyone who can complete a specific task or set of tasks: subscribing to a project on Twitter, joining their Telegram channel, and retweeting one of their tweets or blog posts. Rewards are generally set by crypto projects to attract new users and grow the community;

- Free NFTs: Many new crypto projects are offering NFTs as a “welcome bonus” to their core supporters. You can follow the new cryptocurrency on its Discord or Twitter channel and take part in the invitation bonus pool for the people who drive the most traffic to the channel. Received NFTs can be exchanged for cryptocurrency;

- Airdrop: Developers of a new cryptocurrency can make an airdrop – a process of distributing a new coin to promote it and generate more interest and excitement around it. To be able to receive new coins, you need to follow the crypto project on social networks, on the Discord channel, or otherwise support the project. It’s worth noting that many airdrops are scams, and even if they give you some coins, these coins may be worthless;

- Cryptocurrency Credit Cards: If you already have regular cashback credit cards, you can easily upgrade to Cryptocurrency Reward Cards and receive Cryptocurrency in exchange for purchases. These credit cards may offer rewards for purchases in the form of bitcoin or other popular altcoins. Other spending bonuses may also be available. Two popular options include credit cards from BlockFi and Gemini;

- Web Browsing: The Brave Browser allows you to earn a Basic Attention Token for using the browser if you have enabled the Brave Rewards program. Brave blocks typical ads and cookies, but still allows you to view some advertisements in exchange for cryptocurrency. The program is available in most countries and the company shares 70% of advertising revenue with users. Payments are made once a month;

- Bitcoin faucets: are platforms that reward visitors or users with cryptocurrencies for completing certain tasks. This can be anything from simply entering a captcha, participating in online games, watching ads, online quizzes, and participating in surveys;

- Games: There are various games that allow you to get cryptocurrency for free. For example, Rollercoin gives you a “power” called hash rate. Using this “power”, you can simulate the mining of cryptocurrency right in the game;

- Referral bonuses and affiliate programs: Some crypto exchanges offer rewards for using their services. For example, Coinbase offers a $10 bonus to you and your referral when they create an account and make a trade of at least $100.

What budget do you need to start working with cryptocurrency

Theoretically, it only takes a few dollars to invest in cryptocurrencies. For example, on most crypto exchanges, the minimum trade can be $5 or $10. Other cryptocurrency trading apps may have even lower minimums.

However, be aware that some trading platforms take a commission, which can be a large amount of investment. Therefore, it is important to find a broker or exchange with low commissions.

In addition to trading, some platforms have a low barrier to staking certain coins. There are also offers available for game lovers.

Without a budget, you can earn cryptocurrency through bitcoin faucets, by completing various surveys, through web browsing in a specific browser, airdrops, various games, etc.

Pros and cons of earning on cryptocurrency

FAQ

If you have trading skills and some free time, you can trade on the stock exchange. If you prefer passive income options, you can choose staking, farming or lending. Fans of DeFi games such as Axie Infinity, The Sandbox, Decentraland, etc. can earn crypto while playing them.

However, do not forget that investing in cryptocurrencies is highly risky activity. First of all, due to strong market volatility and the risk of wallet hacking. Therefore, it is important to understand what to invest your money in and do not risk amounts of money you cannot afford to lose.

Comments (0)