The 10 Best Crypto Trading Bots in 2024

Cryptobots or cryptocurrency trading robots have become a popular tool among traders. They help automate the process of entering and exiting trades and to trade more efficiently. The cryptobot is configured, connects to the exchange and starts working according to a pre-set strategy – there is no need to sit at the computer and wait for suitable trading conditions to make a trade.

You can create trading bots yourself, but this will require good knowledge of programming languages. Fortunately, there are services that provide cryptocurrency trading bots, and you don’t need to know programming to set them up.

In this article, we’ll consider what a crypto bot is, what functions it has and how it can be useful. I also compiled my TOP 10 automated trading platforms that you can use.

What is a cryptocurrency trading bot?

Cryptocurrency trading robot is a program that opens and closes trades according to a given instruction. Robots can use various trading strategies, work in flat, trend and on pivots. Robots can also be configured to work in any markets.

To fine-set robots, for example, to trade according to your own strategy, you will need programming skills (most often these are such programming languaged as C, Python or JavaScript) and the ability to work with API exchanges (needed to connect the robot to the trading platform). Less complicated options for setting up robots are provided by special services for automated trading (some of these platforms allow to connect bots written by the user himself).

With the right settings and initial capital, services with trading robots allow you to automate the trading process and make it more efficient. In addition, this is a convenient solution if you are not going to become a full-time trader and understand the intricacies of cryptocurrency market.

List of the best crypto trading bots

There is my top 10 trading automation services below:

1. 3commas

Website: https://3commas.io/

3commas is one of the most famous trading bot services. Offers the most popular trading strategies (DCA, GRID, HODL), the ability to customize your own bots using TradingView signals and popular indicators (RSI, MA, MACD, etc.). AI SMART bot, demo mode and free trial available.

- Price: 3 plans with the option to pay for 1 month and 1 year (50% discount). Cost: from $29/month or $174/year on Basic plan to $99/month or $594/year on PRO plan;

- Exchanges: 16.

Pros and cons

2. Bitsgap

Website: https://bitsgap.com/

Bitsgap is simple and convenient service with trading bots. Supports DCA (MACD, RSI, Stochastic and channel indicators) and GRID strategies. Offers 2 pre-configured strategies for futures markets using DCA and GRID. Has a 7-day trial period and a demo mode.

- Price: 3 plans with the option to pay for 1 month and 1 year (20% discount). From $29/month or $276/year on Basic plan to $149/month or $1428/year on PRO plan;

- Exchanges: 15.

Pros and cons

3. RevenueBot

Site: https://revenuebot.io/

RevenueBot is a service with trading bots that work according to the combined GRID/DCA strategy. Offers minimal options for changing the strategy using indicators (RSI, CCI, Bollinger Bands), TradingView signals and some GRID and DCA settings. One of the main features of the service is settlements in BTC.

- Cost: the service charges 20% of the profit, but not more than $50 per month in BTC equivalent;

- Exchanges: 15.

Pros and cons

4. Cryptohopper

Website: https://www.cryptohopper.com/

Cryptohopper is a large service with extensive options for automating cryptocurrency trading and copy trading. Allows you to create your own strategies based on DCA and GRID using the Strategy Designer (without the need for knowing programming), supports AI-generated strategies, buying and selling strategies. There are back testing, test period, demo trading.

- Price: 3 plans (monthly and annual payment with discount of 14 to 18%) and 1 trial tariff. The cheapest (Explorer) plan costs from $19/month to $199/year, the most expensive (Hero) – $90/month to $999/year;

- Exchanges: 17.

Pros and cons

5. Profitrailer

Website: https://profittrailer.com/

Profittrailer is a cryptobot with classic indicators (40+) and demo trading. Allows you to create bots based on DCA and GRID strategies. Additional customization of strategies using indicators is supported.

- Price: There are free and paid plans. Free ones are limited by the number of exchanges where bots can be used (Binance, Bybit). Paid plans are divided into Basic and Advanced and offer monthly (from €49/month) and one-time payment (from €799);

- Exchanges: 9 crypto exchanges + Forex.

Pros and cons

6. Pionex

Site: https://www.pionex.com/

Pionex is a cryptocurrency exchange with the option to connect robots directly in the trading terminal. Exchange bots can work both according to pre-installed strategies, and configured by the user himself. To set up bots, you can use the options of DCA and GRID strategies, apply indicators (MA, MACD, Bollinger Bands, etc.) or work with ready-made bots (for example, a bot for a HODL strategy for BTC, an index bot for trading a cryptocurrency portfolio, etc.).

- Price: Free. Bots can be used and configured immediately after registration and verification on the exchange (however, there is a trading commission as on any exchange);

- Exchanges: 1.

Pros and cons

7. Trality

Website: https://www.trality.com/

Trality is a platform for creating trading bots using a built-in constructor or Python. There are the service for bots software development, 70+ indicators that can be used in the constructor, a marketplace for subscribing and selling created bots. Among the unique features: virtual bots for testing strategies, demo account with 1000 virtual USDT, back-testing.

- Cost: 4 plans. Pawn free plan allows you to test the platform’s features for a month. Paid plans starts from €9.99/month to €49.99/month;

- Exchanges: 4.

Pros and cons

8. Quadency

Website: https://quadency.com/

Quadency is a cross-exchange platform with the ability to create trading bots with personal trading assistant Cody based on AI. The technology allows you to create bots using a text description of strategies (only English is supported). There is a detailed manual for the AI assistant. In addition to AI development, you can manually customize your bot (you can use TradingView, indicators, GRID, DCA, etc. for customization) or choose any of the 12 pre-configured bots. The platform can also be used as an exchange.

- Cost: free;

- Exchanges: 8.

Pros and cons

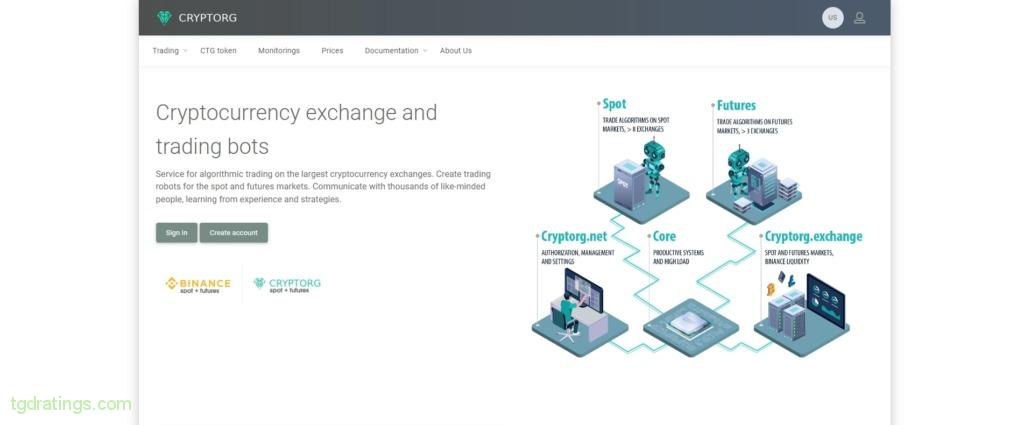

9. Cryptorg

Website: https://cryptorg.net/;

Cryptorg is cryptocurrency exchange with a focus on automated trading on spot and futures. Main feature: on the basic rate plan, you do not need to pay for the created bots if they are used to work on the Cryptorg exchange. Bots can be configured with a combined DCA/GRID strategy, indicators (MA, MA crossovers, Stochastic, FOMO) and TradingView signals.

- Price: 4 monthly plans. The basic plan (Trial) costs $15/month after 14 free days. The most expensive (Business) – $100/month;

- Exchanges: 2.

Pros and cons

10. Gunbot

Website: https://www.gunbot.com/

Gunbot is an application for PC with the options to deep bot customization at the code level and generate AI strategies. Works on Windows, Linux, MacOS, Raspberry Pi. Allows use of combined DCA and GRID strategies. Deep settings are available using the AutoConfig tool, JavaScript, TradingView signals and built-in indicators (MA, MACD, Stochastic, Bollinger Bands, etc.). Allows you to code strategies with Gunbot AI. Has pre-set strategies. The native Gunthy token can be used to pay for the application.

- Price: 3 paid and 1 trial plan. It is possible to separately purchase extensions and a native token. 3-day trial mode supports 5 exchanges, 1 trading pair, 2 preset strategies. Paid plans cost from 0.014 BTC/month to 0.04 BTC/month;

- Exchanges: 24 exchanges, plus an option to work with sites that support the CCXT (Crypto Currency Exchange Trading library).

Pros and cons

Types of cryptocurrency trading bots

There is confusion in trading bots classification because they are often called by the name of the strategy they use. To bring some clarity to these two concepts, I have briefly described the main strategies that are used when creating bots.

Classification of bots by types of implemented strategies

DCA bots

DCA strategy (Dollar-cost averaging) involves the purchase of an asset at regular intervals. This minimizes the effect of cryptocurrency volatility, and the position is constantly increasing until the moment of closing. Bots that use this strategy as a basis are called DCA bots.

GRID Bots

GRID strategies are used to increase a position value in an asset through certain price intervals (linear or logarithmic) until the trade is closed. There are many variations of this strategy, and it can be used as a part of other approaches. Bots using this strategy are called GRID bots.

HODL bots

HODL-bot is a bot that works according to the HODL strategy. It implies the constant purchase of assets, as in the DCA strategy, and their retention for a long time. It is considered as investment strategy and is suitable for people who do not have the opportunity or time to constantly monitor the market.

Sandwich bots

Sandwich bots are bots that make quick orders in exchange order books. They use the effect of slippage and the principle of market-making “first in, first out” – first come, first served. The bottom line is to have time to complete a request to the exchange faster than a trader or other bot within the slippage range (set on the exchange) and make a deal on favorable terms. After that, the sandwich bot buys or sells the asset to the next trader or bot in line at a favorable price. These bots are programmed manually.

Trailing bots

Bots that allow you to accompany a trade with a trailing stop, with subsequent pivot or closing of the trade. Often stand out as a separate view, but, as a rule, they are built on the elements of GRID and DCA strategies.

Arbitrage bots

Bots for arbitrage trading. They can automatically exchange one cryptocurrency asset for another in cryptocurrency arbitrage trades on trading platforms of various types.

Classification of bots by application methods

In addition to trading robots, which are named after strategies and used quite often, there are separate types of bots. They are classified to the methods of application. There are some of the main such bots below.

SMART bots

Smart bots are often referred to as bots that use machine learning or AI. They can work with different strategies. A detailed description of their work is available on the respective platforms. For example, 3commas has such type of bots.

Copytrading bots

Bots are often used by traders for automation. After setting up and testing the effectiveness, this bot can sell for a percentage of profits or a subscription on the marketplaces on exchanges or platforms that support copy trading. They use a wide range of strategies, the most popular of which is Martingale.

Bots for market making

Any bot that allows you to place limit orders on an exchange can be called a market making bot. One of use example: trading within a slippage range or inside price spreads. Sandwich bots can be partly attributed to this type.

Bots in Telegram

Bots in Telegram most often perform the function of informing about the situation with the trading bot on the exchange or are used as a signal bot. However, some services also offer the ability to directly control trading bots on the exchange through a bot in Telegram (change settings, start, stop, etc.). Telegram bots are not used for automated trading on the crypto exchange.

Important cryptocurrency bots features

In addition to being able to customize key options, good bots have some important additional features. Most often they are related to performance testing, speed and technical support.

Back-testing

Backtesting is a test of the effectiveness of the bot on the historical data of the asset price. Helps to accurately set bot settings and select the most profitable solutions.

Cloud based vs. Server based

Basically, trading bots use cloud computing power to work. This means that all calculations take place on the equipment of the intermediary company. Some exchanges use their own server solutions. You can specify what type of bot belongs to in the support service or in the service description. The infrastructure used to run the bot may affect security and data transfer speed.

Free trial

Most bots have a free trial period (usually from 3 days). This is convenient when you need to evaluate how the service works, what settings are offered, what the robot can do, and so on.

Customer support

Like any technical solutions, bots can face a whole range of problems: from a freeze to blocking work on a certain exchange. In order to quickly resolve these problems, it is very desirable to have a good support service. Best, it should be work 24/7. You can check the work of support during the test period.

Conclusion

Cryptocurrency trading robots is a convenient way to make money on cryptocurrencies without having to constantly be at the PC and monitor the market. You can program bots on your own or find ready-made solutions on special resources, exchanges and in the form of separate offers. As a rule, such services are sold bots on a monthly or annual subscription. In their work, bots use various strategies, the main ones are DCA and GRID. After a surge in interest in AI, some sites also offer self-learning bots or a constructor for them based on machine learning technologies.

FAQ

Comments (0)