Copy Trading: The Ultimate Guide

With the growing popularity of cryptocurrencies, the number of crypto traders is also growing: someone is just trying out a new activity for themselves, and someone earns a living this way. Many new traders and investors use copytrading – they repeat the trades of successful traders which are ready to share their experience. Copy trading allows beginners to immediately make successful trades and learn from more experienced market participants.

How copy trading differs from traditional trading

Copying trades means that the trader/investor:

- Finds a trader whose trading results he likes and who agrees anyone to copy his trades;

- Then he completely repeats the actions of the signal provider, and does not make independent decisions about opening and closing of trading orders.

Instead of following the market and making trading decisions yourself, one trader repeats the actions of more experienced trader (who trade manually or with a help of trading robots). At the same time, he can disable copy trading at any time and close opened orders on his own.

Benefits of copy trading

Copy trading as a trading strategy has clear merits. I reviewed the main ones.

Saving time and convenience

Using copy trading, a trader/investor does not have a need to analyzing market, reading news, determining the best moments for opening and closing positions, maintaining open transactions, etc.

Learning from experienced traders

Copy trading allows beginners to make profit from trading with minimal knowledge and preparation, and to gain a deeper understanding of the market during the process of trading and accumulate their own experience.

Diversification and risk management

There are many traders on the market offering their services, and each of them uses their own strategies and trading systems. Use of different sources makes it possible to diversify risks.

How copy trading platforms work

Copy trading platforms work as follows:

- The user makes an account on the platform and replenishes the deposit;

- Then one selects trader and connects his account to his trading strategy;

- On the last step investor sets copytrading parameters and monitors trading results.

Trades can be copied in two ways: manually or automatically. The manual method assumes that after sending his own trade request, the trader broadcasts all the parameters (volume, price, assets, etc.) to other users. The copying person can choose whether to enter this trade or not, as well as change the parameters (for example, reduce the volume). With automatic copy trading, signals from a trader are immediately sent to the trading terminal and placed automatically.

How to start copy trading?

Let’s take a look at how to get started with a copy trading platform. The instruction includes 5 steps, each of which is equally important.

Choosing a platform

Choice of a platform based on the overall rating of the trading platform and copy trading opportunities in particular. Also you should pay attention to other exchange requirements, such as identity verification.

I will use ByBit as an example. Bybit copy trading services are used by 670+ thousand investors. There are professionals among them who share their trades and ones who copy their strategies.

Registration

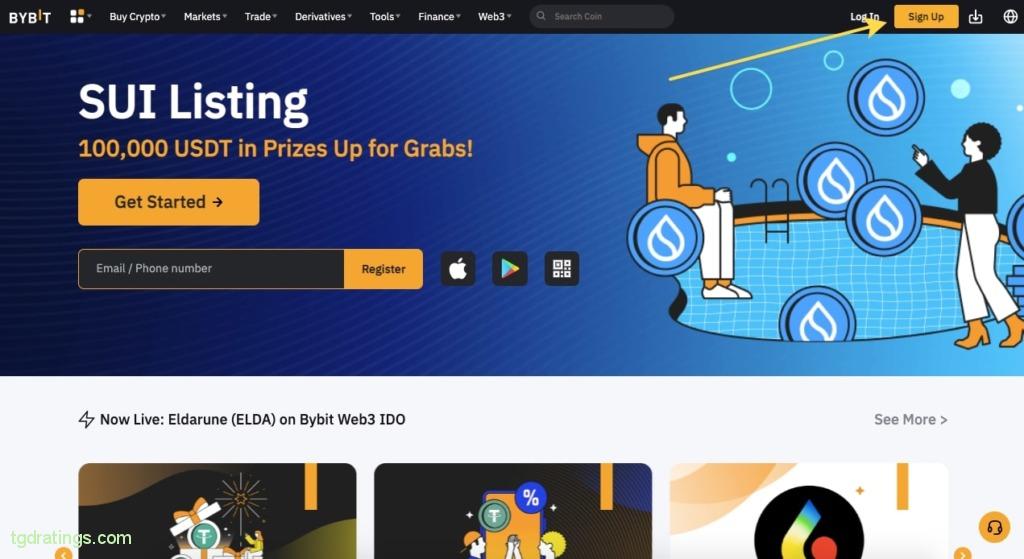

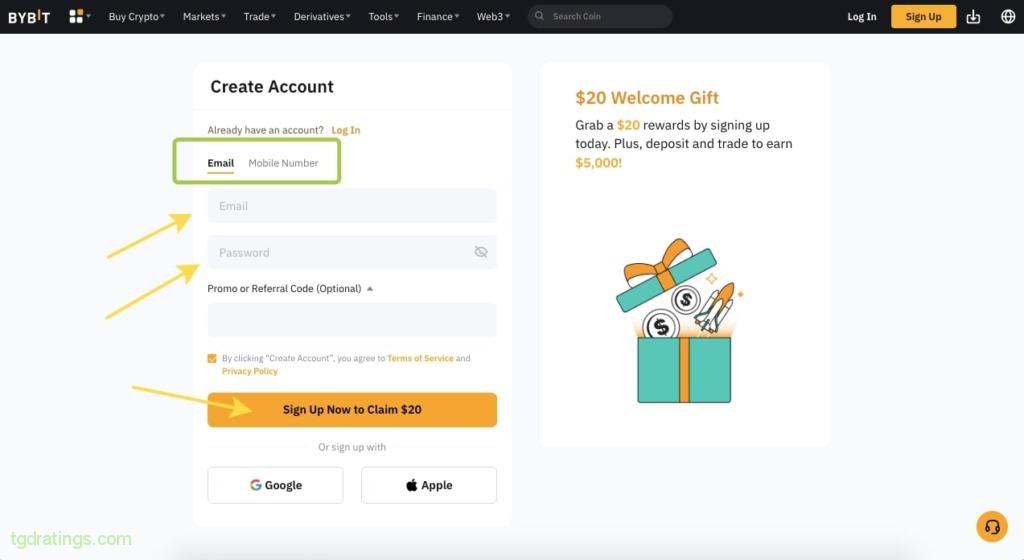

After choosing an exchange with a copy trading function, you will need to create an account there. To sign up for Bybit:

- Select the Sign up option on the official website of the exchange;

Registration on Bybit - Select registration method: by email or by phone number;

- Generate password;

- Click Sign up.

Account settings

Every new user of the exchange must be sure to pass identity verification. Verification level Lv.1 will be available as first (after the basic verification then the advanced verification level Lv.2 also become available).

To start the verification process, select Verify now and provide the required documents.

Deposit replenishment

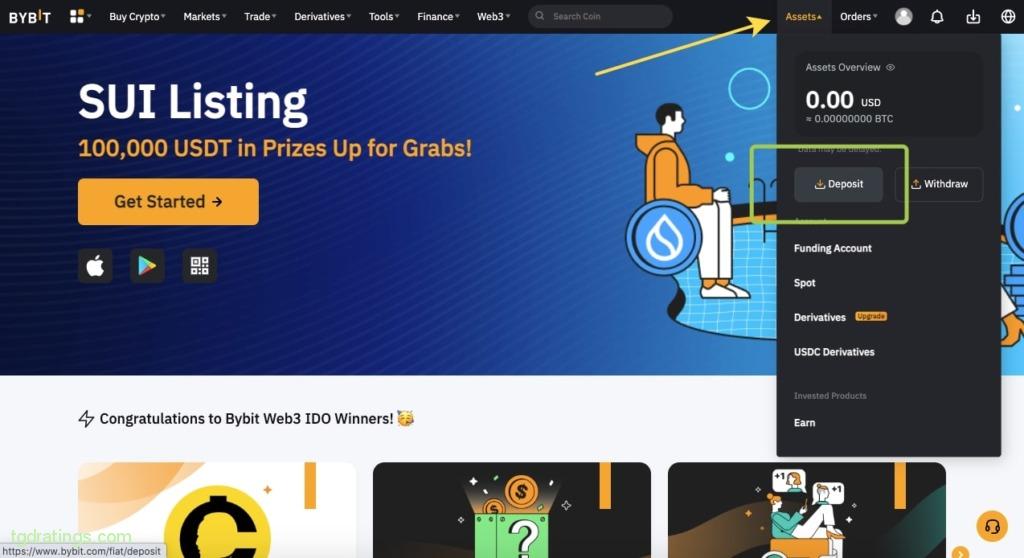

To copy trades on Bybit, you must have USDT stablecoin on your account.

To make a deposit in USDT:

- Click on the profile icon and select Assets → Deposit;

Deposit - Click USDT in the currencies list,;

- Specify network (for example, ERC20). You will also need to select the ERC20 network in the sending wallet, otherwise you will lose the funds;

- Copy the USDT address generated by the system and paste it in your wallet;

- Check up the receipt of funds on your exchange account.

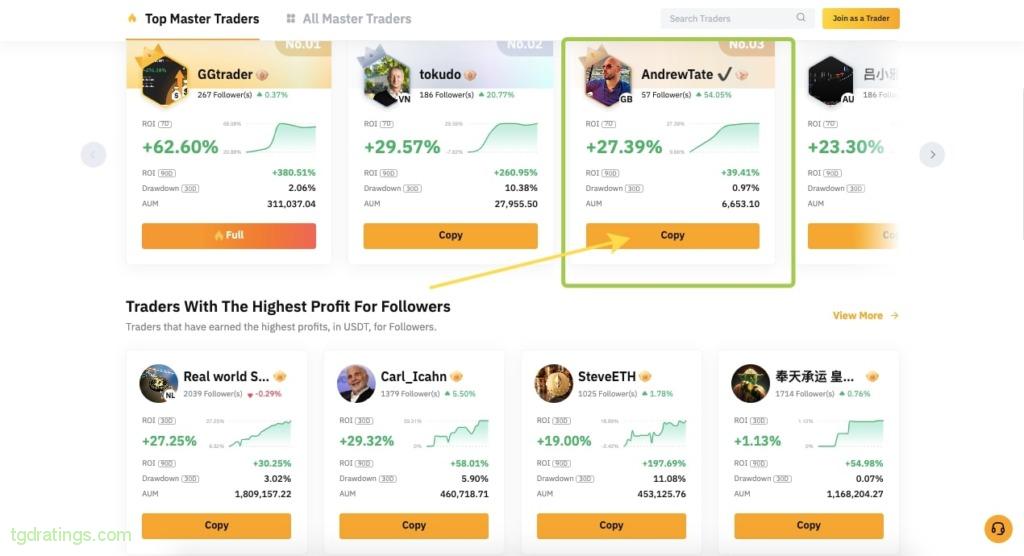

Traders selecting

Copy trading platforms offer various filters to select the best traders. Among the main ones: ROI (profitability), drawdown (drawdown), Win rate (the ratio of profitable trades to unprofitable ones), PnL (net profit or loss), PnL followers (profit and loss of followers), number of followers and other parameters.

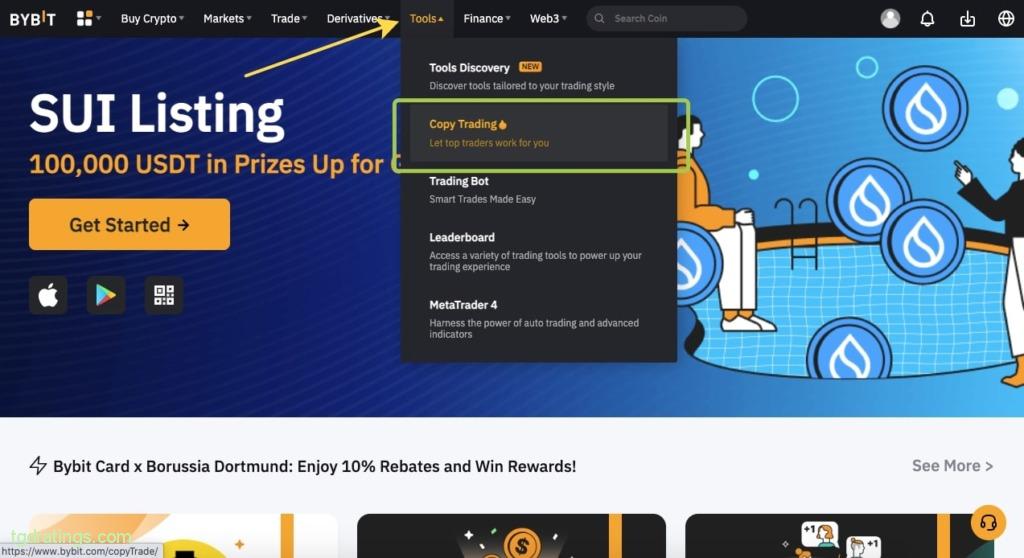

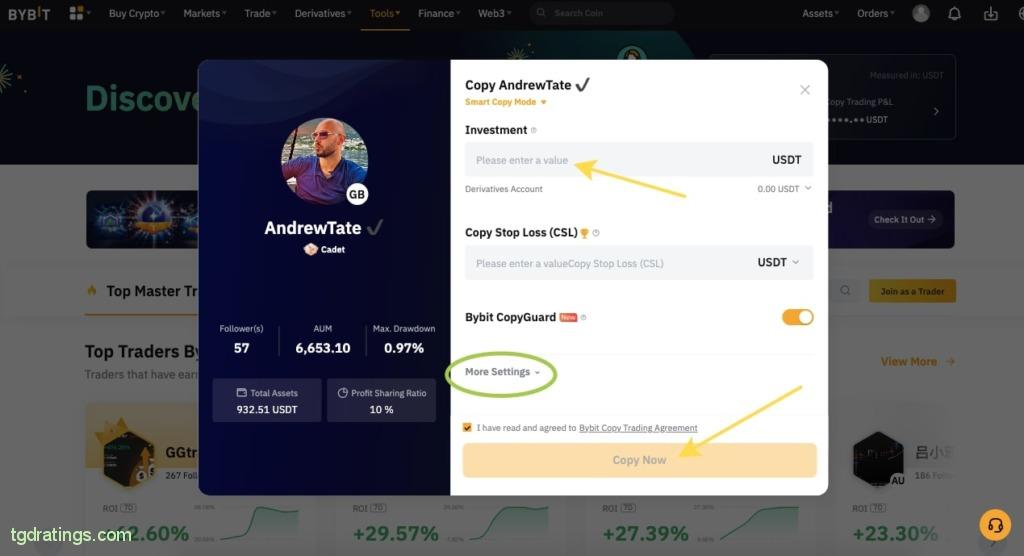

We proceed directly to copy trading on Bybit. For this:

- Select the tab Tools → Copy Trading on the main page;

Copy trading - On the copytrading service page, check the offers and select a trader → click Copy;

Selecting the traders - There will open a page with more detailed information about the chosen trader. Here you also need to specify the amount you are investing and other settings (click More Setting to see more);

Copy trading application - Click Copy Now.

Best cryptocurrency copy trading platforms in 2024

Consider 7 reliable and proven platforms with copy trading services.

1. Bybit

Address: https://www.bybit.com/copyTrade/

Bybit’s copy trading platform is used by 670+k users. Bybit offers copy trading on the spot platform and derivatives. To select the best traders, you can use various filters according to certain criteria (ROI, PnL, lowest drawdown, etc.).

- Verification for traders and subscribers: required;

- Available contracts: 61+ (BTCUSDT, ETHUSDT, EOSUSDT, XRPUSDT, LTCUSDT, LINKUSDT, ADAUSDT, DOTUSDT, etc.);

- Trader reward: 10%;

- Number of subscriptions allowed: 10.

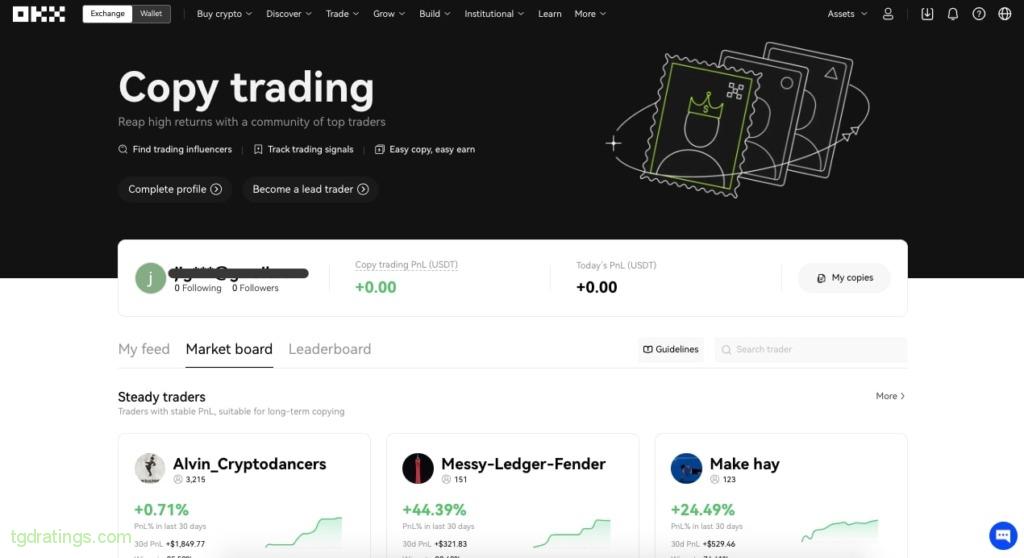

2. OKX

Address: https://www.okx.com/copy-trading

Copy trading on OKX allows you to subscribe to the best traders or become a lead trader yourself. You can view lists of top traders and choose whose you want to copy (based on PnL and win rate). Еру traders with stable PnL who are suitable for long-term copying highlighted separately.

- Verification for traders and subscribers: required;

- Available contracts: 60+ (ETH, BTC, LTC, DOGE, XRP, ETC, APT, SOL, MATIC, DOT, etc.);

- Trader reward: 10%;

- Number of subscriptions allowed: 5 – when using the Open/Close position mode or 1 – when using the Buy/Sell position mode.

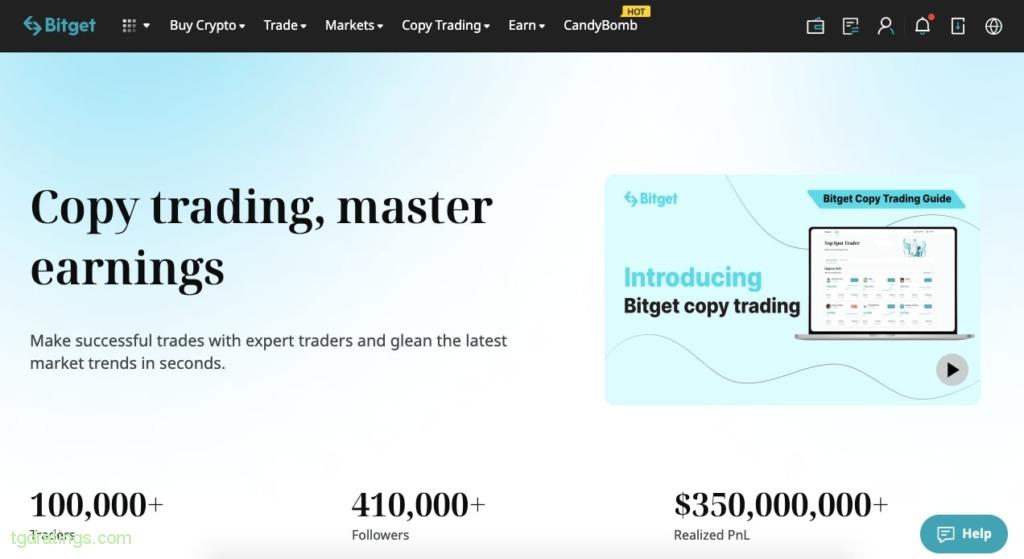

3. Bitget

Address: https://www.bitget.com/copytrading/overview

Bitget is a large crypto exchange that is actively developing in the field of copy trading. In 2020, the One-Click Copy Trade service appeared on the platform. Now copy trading on Bitget is 410,000+ subscribers and 100,000+ professional traders.

Spot copy trading, futures copy trading, strategic copy trading are available there. You can select a trader using various filters (highest ROI, highest PnL, PnL of followers, number of followers), as well as based on the analysis of historical trading data.

Leverage can be set for all pairs available for copying.

- Verification for traders and subscribers: optional;

- Available contracts: 170+ (BTC/USDT, ETH/USDT, XRP/USDT, DOGE/USDT, SOL/USDT, USDC/USDT, BNB/USDT, GALA/USDT, APT/USDT, OP/USDT);

- Trader reward: 10%;

- Number of subscriptions allowed: no limit.

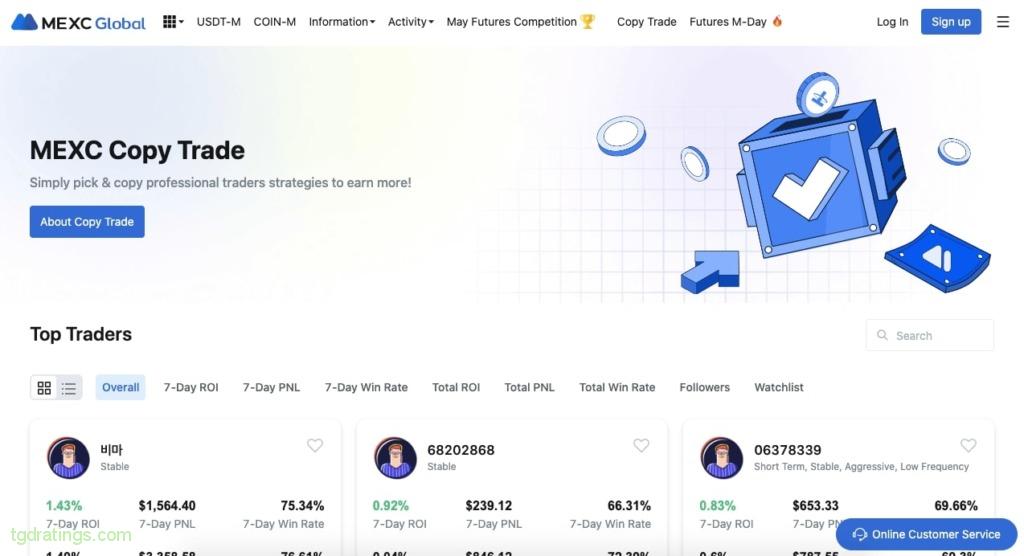

4. MEXC

Address: https://futures.mexc.com/copyTrade/home

The MEXC exchange offers users futures copy trading . Filters can be used to select a trader: 7-day ROI, 7-day PNL, 7-day success rate, total ROI, total PNL, total success rate, number of followers.

- Verification for traders and subscribers: optional for subscribers and required for traders;

- Available contracts: 70+;

- Trader reward: 10%;

- Number of subscriptions allowed: no limit.

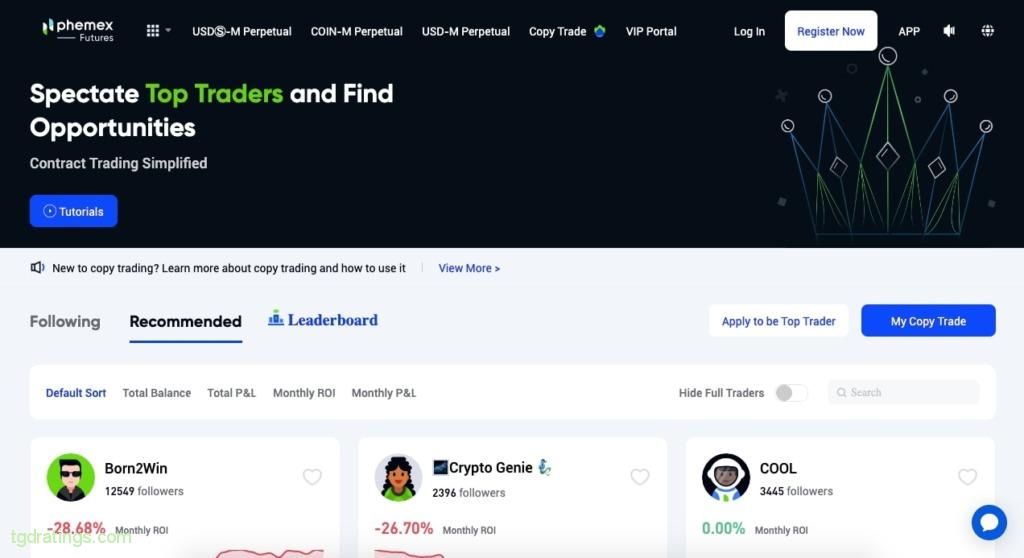

5. Phemex

Address: https://phemex.com/copy-trading/list

USD margined perpetual contracts are available for copy trading on Phemex (USDT margined contracts will be added shortly). You can sort traders by different criteria: balance sheet, monthly ROI, monthly profit and loss, etc. A leaderboard is also available (information in there is updated every 5 minutes).

- Verification for traders and subscribers: optional;

- Available contracts: 12 perpetual contracts with USD margin: BTC, ETH, DOT, LINK, ADA, SOL, UNI, XRP, LTC, XTZ, DOGE, BNB;

- Trader reward: from 12 to 20% (depending on the level of the trader);

- Number of subscriptions allowed: 3.

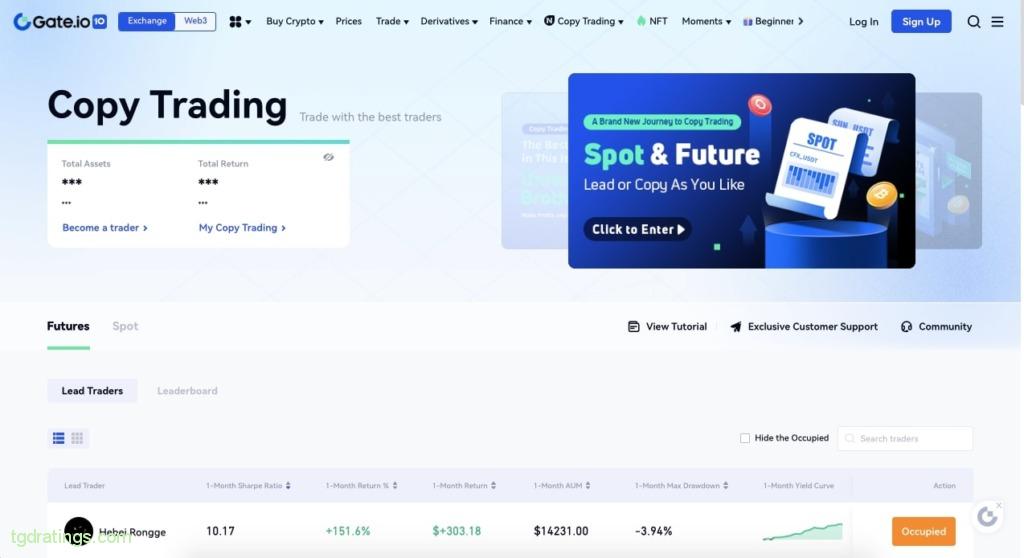

6. Gate.io

Address: https://www.gate.io/copytrading

Gate.io offers spot and futures copytrading. After selecting a trader to copy, the user selects copy mode (custom and auto-copy). To get started, the copy trader must transfer funds from the spot account to the copy trading account.

- Verification for traders and subscribers: required;

- Available contracts: 30+ (BTC/USDT, ETH/USDT, SOL/USDT, DOGE/USDT, LTC/USDT, SHIB/USDT, PEOPLE/USDT, GMT/USDT, TRX/USDT, LUNA/USDT, etc. .);

- Trader reward: 8-16%;

- Number of subscriptions allowed: no information.

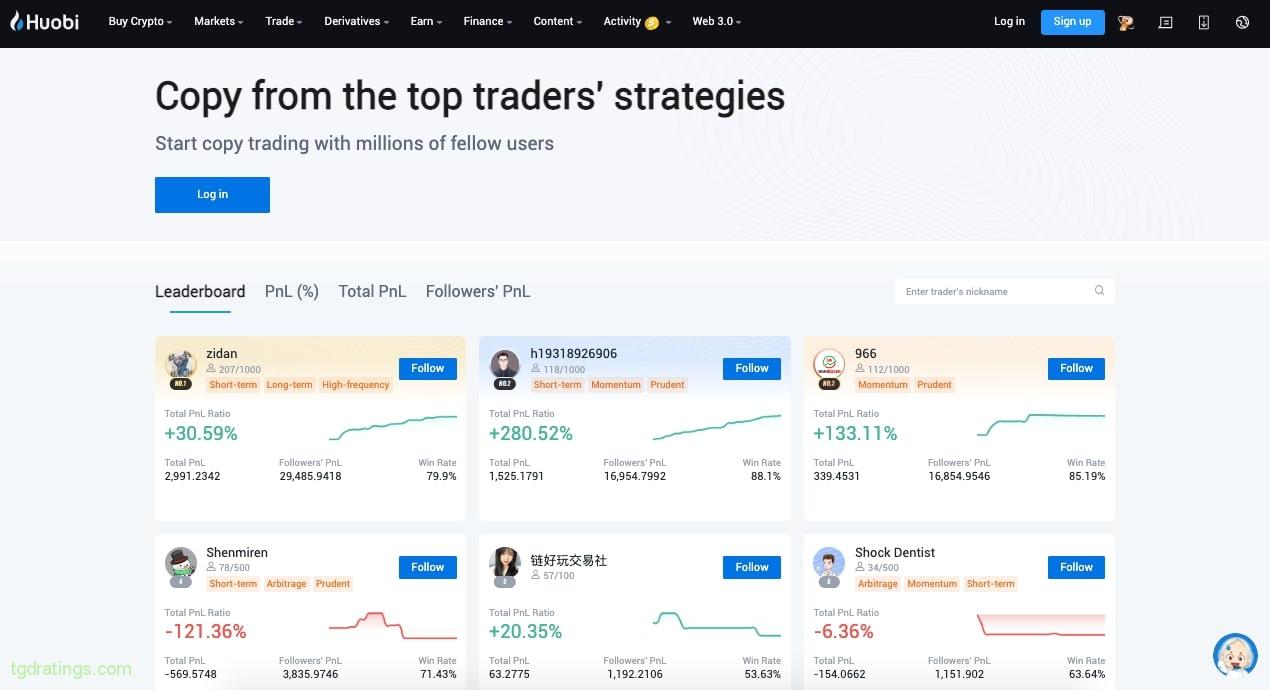

7. Huobi

Address: https://www.huobi.com/en-us/futures/copy_trading/

Huobi offers users copy trading for derivatives. A copy trader can choose a trader he likes from a pool of traders who have passed a rigorous selection. Huobi provides detailed trading data about each trader: total PnL (USDT), number of followers, win rate, ROI and daily PnL charts, futures trading data, current and past positions, number of followers, etc.

- Verification for traders and subscribers: required;

- Available contracts: BTC/USDT, ETH/USDT, DOGE/USDT, LTC/USDT, etc.;

- Trader reward: 15-25%;

- Number of subscriptions allowed: no information.

Risks and limitations

There is no general point of view about copying other people’s orders. Copy trading has truly empowered beginner traders and investors and allowed them to trade alongside professional traders. However, before embarking on this strategy, it is important to know the risks.

Dependence on successful traders

One of the main problems is that copy trader becomes dependent on the trader he is copying and loses control over his money. He cannot decide for the trader which trades to enter and when to exit.

In addition, the copy trader sees only the trader’s statistics and his profile picture. And even if the numbers are impressive, there is no guarantee that the trader will not make some rash or risky decision. This can lead to an instant loss of profit or even the entire balance. You can set certain parameters, for example, set limits on losses in %, but this will not save you from unsuccessful orders.

Losses potential

Copy trading is a highly risky type of trading. The copyist must always be prepared for the fact that at any moment he can lose, and bear the responsibility for this. Traders cannot guarantee that they will be able to trade only in plus: losses can occur at any time.

Conclusion

Copy trading means copying in the simplest sense: one trader makes a deal, the second one is copying what the first one does.

It is a a kind of social trading that allows beginners and inexperienced traders to copy the trades of successful and profitable traders with good performance. Limited knowledge about financial markets and lack of experience does not prevent users from actively participating in trading and investing in cryptocurrencies.

Among the main advantages of copy trading: saving time and convenience, the opportunity to learn from experienced traders, risk diversification. Objective disadvantages – dependence on succesful traders and exposure to losses.

FAQ

Comments (0)