Best decentralized crypto echanges (DEX) in 2025

Decentralization is the main idea behind digital money. However, most cryptocurrency exchanges are centralized (they control transactions and store users’ funds). The absence of regulating center for transactions with crypto assets was the goal of creating decentralized trading platforms.

When working with decentralized platforms, users do not need to trust their funds to third parties. The exchange acts only as a place to conduct a transaction, while all funds are stored in users’ wallets.

We may talk about DEX exchanges as about a new round in development of crypto industry. They are based on smart contracts, so all processes are fully automated. In addition, when working with the DEX, users remain completely anonymous. Getting started with such platforms is simple: you just need to connect your crypto wallet to the exchange.

In this article, I reviewed the best DEX exchanges and the criteria for choosing them.

Top 10 best decentralized cryptocurrency exchanges in 2025

Let’s take a look at the top 10 DEX platforms and their features.

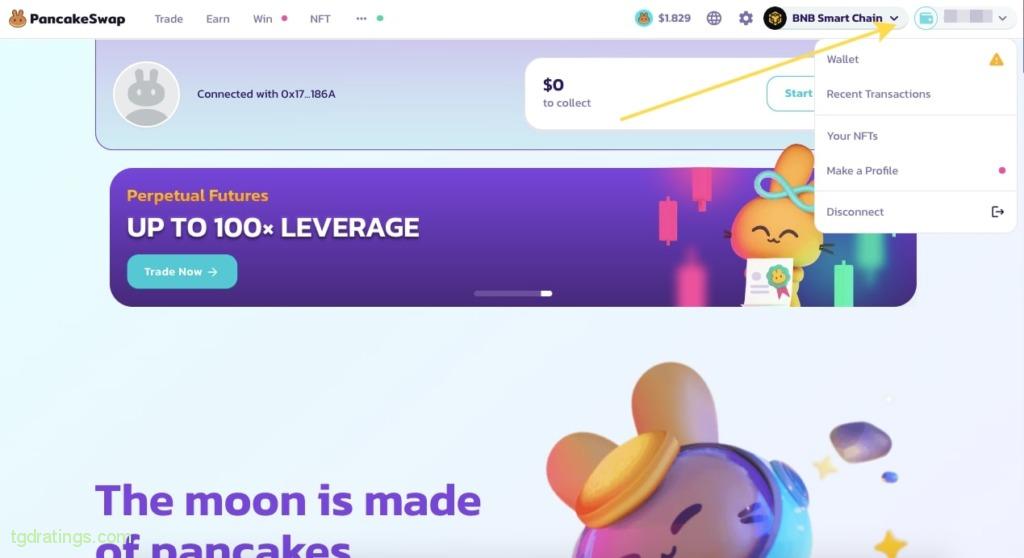

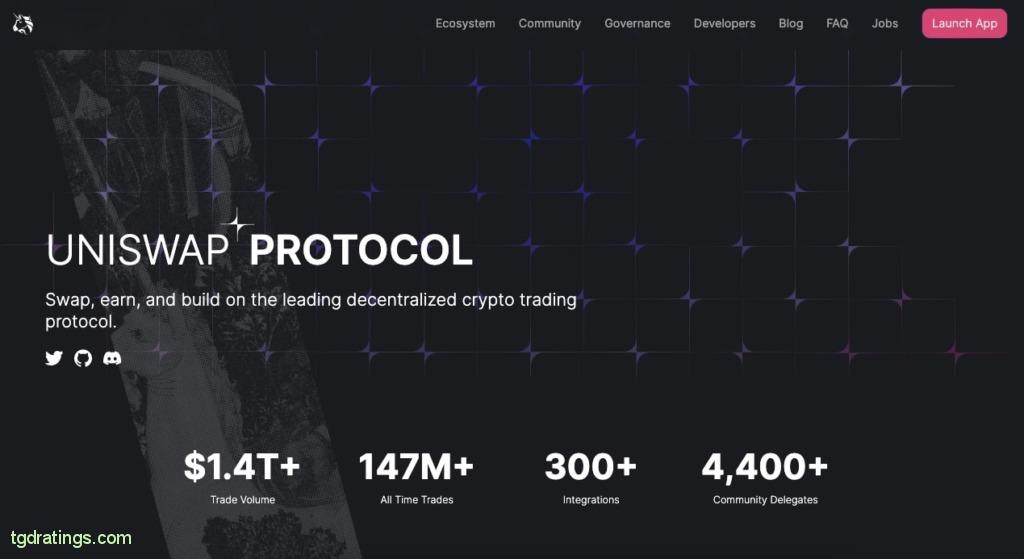

1. Uniswap

Address: https://uniswap.org/

Uniswap is one of the first decentralized marketplaces, created in 2018. At first, the exchange only supported pairs with Ethereum, but in 2020, the second version, Uniswap V2, was released, and it had a much wider list of available pairs. A feature of the third version of Uniswap V3, released in 2021, was the introduction of the concentrated liquidity mechanism (it means that liquidity is not distributed evenly, but where it is most needed at one time or another).

Uniswap is one of the most liquid and largest DEX exchanges. The platform integrates with 200+ DeFi sites and supports a large number of crypto wallets.

- Foundation year: 2018;

- Fees: 0.05%, 0.3% or 1% (depending on the expected volatility of cryptocurrencies);

- Cryptocurrencies available: Uniswap V2 (Ethereum) – 1980+, Uniswap V3 (Arbitrum One) – 160, Uniswap V3 (Ethereum) – 890+;

- Number of trading pairs: Uniswap V2 (Ethereum) – 3400+, Uniswap V3 (Arbitrum One) – 620+, Uniswap V3 (Ethereum) – 1700+;

- Additional features: earning on liquidity providing (one can add coins to existing pools or create your own), an internal UNI token for managing the protocol.

2. PancakeSwap

Address: https://pancakeswap.finance/

PancakeSwap is also one of the largest DEX exchanges with millions of users and more than $2.2 billion locked up on the platform.

The platform runs on three blockchains: BNB Chain, Ethereum and Aptos. PancakeSwap has wide functionality: it allows you to exchange cryptocurrencies, work with NFTs, participate in IFO (Initial Farm Offering), etc.

- Foundation year: 2020;

- Fees: 0.25%;

- Cryptocurrencies available: 3300+;

- Number of trading pairs: 3500+;

- Additional features: trading perpetual contracts, limit orders, farming, competitions and lotteries, NFT, affiliate program, participation in IFO.

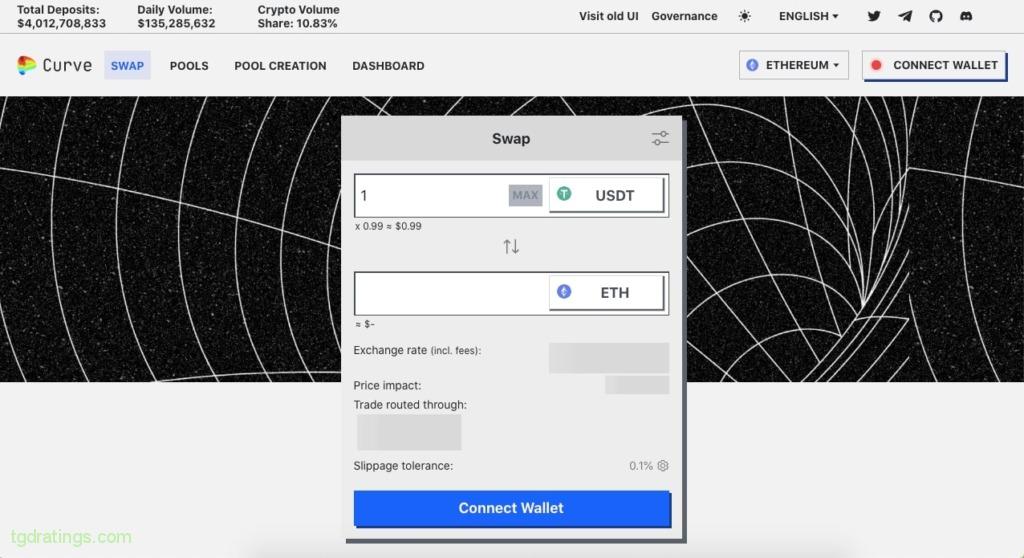

3. Curve

Address: https://curve.fi/

Curve specializes in stablecoin exchanges. It offers multiple liquidity pools and has a own stablecoin smart contract that reduces transaction fees and increases liquidity provider revenue.

- Foundation year: 2020;

- Fees: from 0.04%;

- Cryptocurrencies available: 70+;

- Number of trading pairs: 100+;

- Additional features: liquidity pools, CRV staking, Curve DAO voting system.

4. dYdX

Address: https://dydx.exchange/

dYdX is a professional decentralized exchange specialized in trading perpetual contracts. The platform is built on a layer 2 solution for Ethereum – StarkEx. To ensure a high level of decentralization as well as confidentiality. It provides due to Starkware zero-knowledge proof protocol.

- Foundation year: 2019;

- Fees: 0% – 0.02% for makers, 0% – 0.05% for takers;

- Cryptocurrencies available: 36;

- Number of trading pairs: 36 contracts;

- Additional features: margin trading, perpetual contract trading, NFTs.

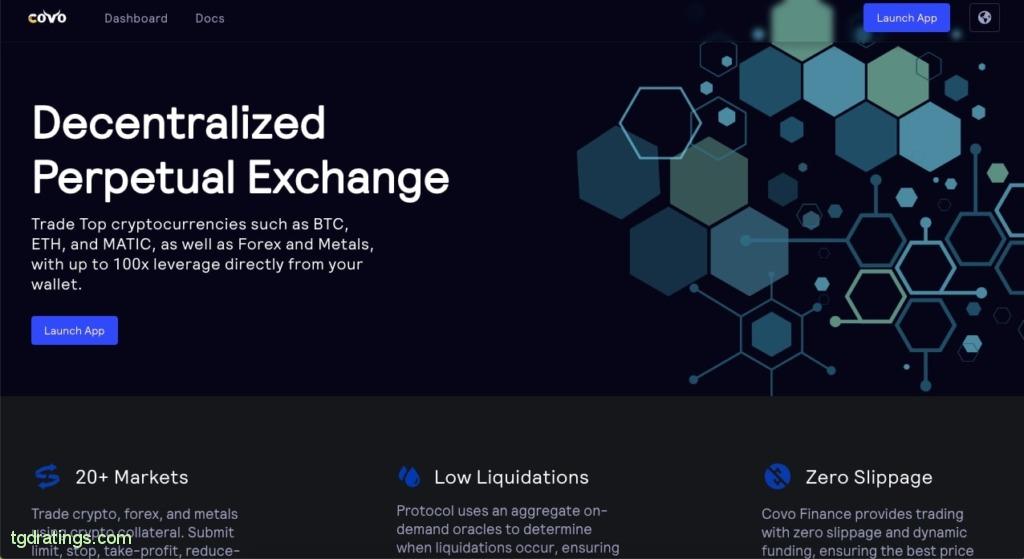

5. Covo Finance

Address: https://covo.finance/#/

Covo Finance is a DEX platform for perpetual contracts trades. Users can trade top cryptocurrencies such as BTC, ETH and MATIC as well as Forex and metals. It is possible to place limit, stop loss and take profit orders, short orders and OCOs with leverage up to 100x.

The protocol provides zero slippage trading with dynamic funding, which guarantees the best price for orders without additional fees.

- Foundation year: 2023;

- Fees: from 0.2% to 1% (depending on the trading pair);

- Cryptocurrencies available: 10;

- Number of trading pairs: 10 Crypto/USD pairs, 9 FX pairs (USD/Fiat), XAG/USD (spot Silver/USD);

- Additional features: staking, COVO Wallet, affiliate program.

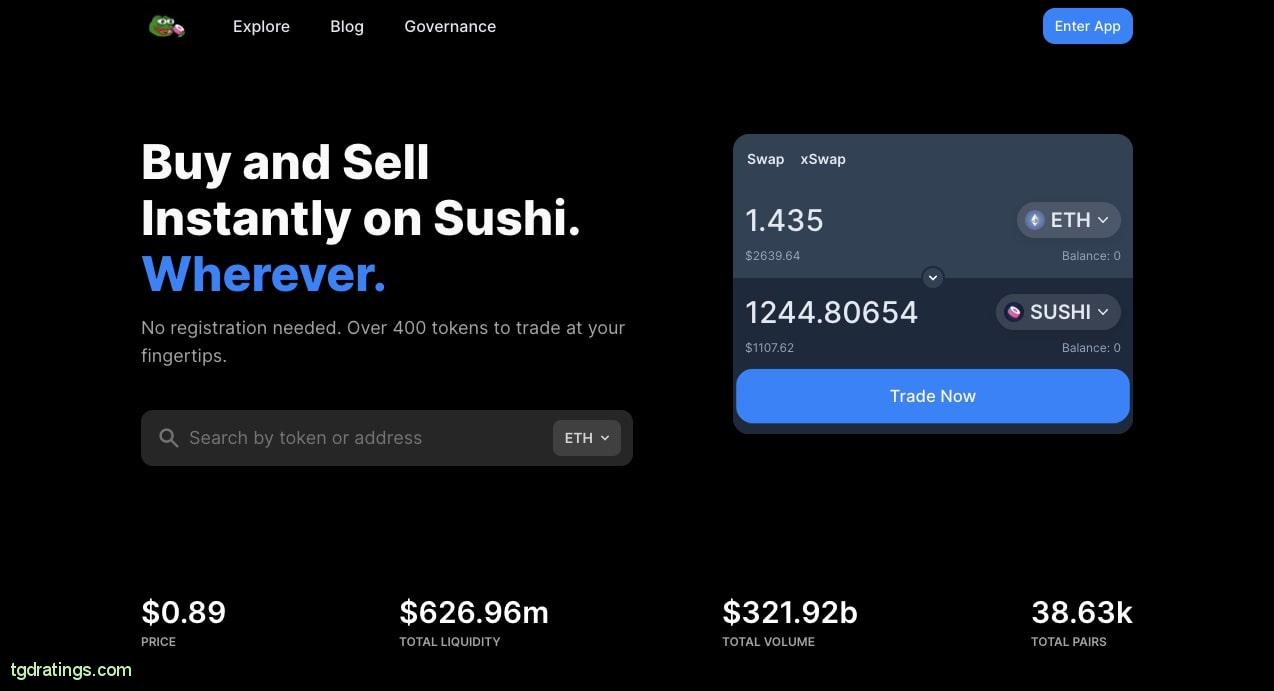

6. Sushiswap

Address: https://www.sushi.com/

The Sushiswap protocol is a fork of Uniswap (based on the same code) and uses the Automated Market Maker (AMM) model. For filling the pools, platform users receive liquidity provider tokens — SLP.

In addition to trading, the platform has a lending market and tools for passive income.

- Foundation year: 2020;

- Fees: 0.3%;

- Cryptocurrencies available: 300+;

- Number of trading pairs: 450+;

- Additional features: liquidity mining, staking, farming.

7. Kyber Swap

Address: https://kyberswap.com/

KyberSwap is an ecosystem that includes DEX exchange KyberSwap and decentralized exchange aggregator. The exchange allows users to make transactions using any of 12 supported networks, including Ethereum, Polygon, BNB, Avalanche and Optimism. The exchange aggregator analyzes rates from 67+ DEX and provides users with the best prices. To make this service use dynamic trade routing technology.

KyberSwap is also focused on maximizing profits for liquidity providers by allowing ones to earn more rewards and fees for tokens placed in pools.

- Foundation year: 2018;

- Fees: 5 levels (0.008%, 0.01%, 0.03%, 0.04% and 1%);

- Cryptocurrencies available: 8;

- Number of trading pairs: 16;

- Additional features: buying cryptocurrency using a card, staking, farming.

*Data are for Kyberswap Elastic (Polygon) protocol.

8. DODO

Address: https://dodoex.io/

DODO is a multi-platform protocol that uses the Proactive Market Maker Algorithm (PMMA). This allows users to make more accurate rate and liquidity calculations than standard AMMs.

Another feature of the platform is the Crowdpooling protocol, which combines crowdfunding and liquidity pools. Crowdpooling works according to the principle of an auction: a user places tokens for a certain period at a fixed cost, and other users invest in tokens, increasing demand for them. After the end of the campaign, investors receive a reward proportional to their contribution.

- Foundation year: 2020;

- Fees: 0.3%;

- Cryptocurrencies available: 4;

- Number of trading pairs: 8;

- Additional features: liquidity mining, NFT.

9. ApeX Exchange

Address: https://www.apex.exchange/

ApeX exchange is a derivatives decentralized crypto exchange created by the popular CEX exchange Bybit. It offers perpetual contracts with up to 30x leverage and low fees.

- Foundation year: 2022;

- Fees: 0.02%/0.05%;

- Cryptocurrencies available: 10+;

- Number of trading pairs: 14+;

- Additional features: staking, referral program.

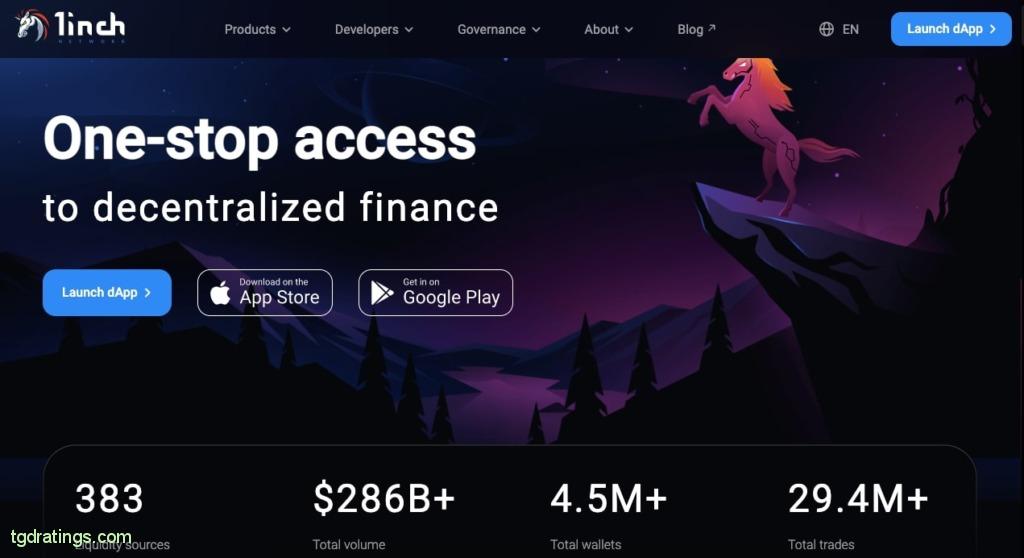

10. 1inch

Address: https://1inch.io/

1inch is a DEX liquidity aggregator using data from 380 real-time liquidity sources. Thus, 1inch offers users better rates than any single exchange.

1inch Liquidity Protocol is a next-generation AMM that protects users from preemptive attacks. The 1inch limit order protocol provides an innovative DeFi limit order exchange experience.

Centralized vs. decentralized exchanges

Unlike centralized exchanges, DEX exchanges do not store user assets and do not have access to private keys. The funds come directly from the user’s wallet, which connect to the platform before starting work.

The fundamental difference between DEX and CEX exchanges is also in how the trading process perform. A distinctive feature of DEX sites is the automated market maker (AMM) technology. Decentralized exchanges do not have an order book, instead they use liquidity pools. They represent reserves for each trading pair, which are created to accumulate the required amount of assets (one liquidity pool is a reserve for one pair). When using AMM, an exchange user submits a request to a liquidity pool that holds funds from a large number of liquidity providers. This allows you to make instant exchanges and get a fair price, which is determined by the ratio of supply and demand.

Another significant difference between DEX platforms is that they do not require registration and identity verification, like the most centralized exchanges.

Main criteria for choosing the best DEX

To choose a DEX exchange, you should evaluate the platform on several criteria: user interface, supported cryptocurrencies, liquidity and fees.

Supported cryptocurrencies and trading pairs

The advantage of the trading platform is the wide selection of trading pairs. This allows you to choose the most suitable cryptocurrencies for trading and diversify your portfolio.

Liquidity and trading volume

As a rule, DEX platforms are inferior to centralized exchanges in terms of liquidity. Therefore, choose the option with maximum liquidity and trading volume.

Fees

Fees are one of the most important aspects when choosing a DEX exchange. The less you pay to the platform, the more it is profitable for you.

User interface and ease of use

The trading platform should be easy to use. You should see how the site navigation works, is a trading terminal easy to operate, and how quickly you can make transactions.

How to start working on DEX cryptocurrency exchange?

On decentralized exchanges, you do not need to register, create an account, go through verification and replenish the exchange wallet. It is enough just to connect your crypto wallet to the platform.

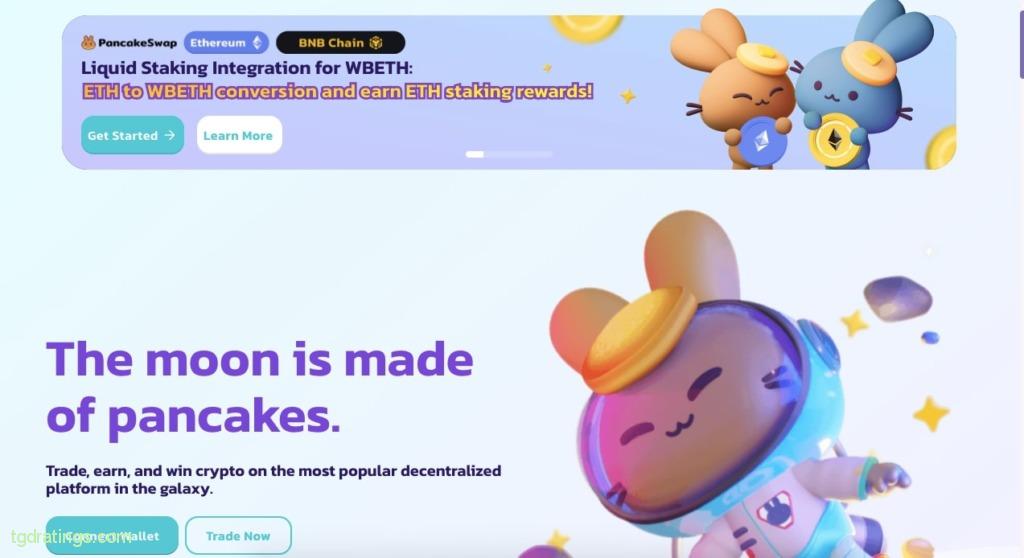

Let’s take a look on example of how to get started with a DEX exchange. For this we’ll be using the Pancakeswap exchange and Trust Wallet.

Crypto wallet settings

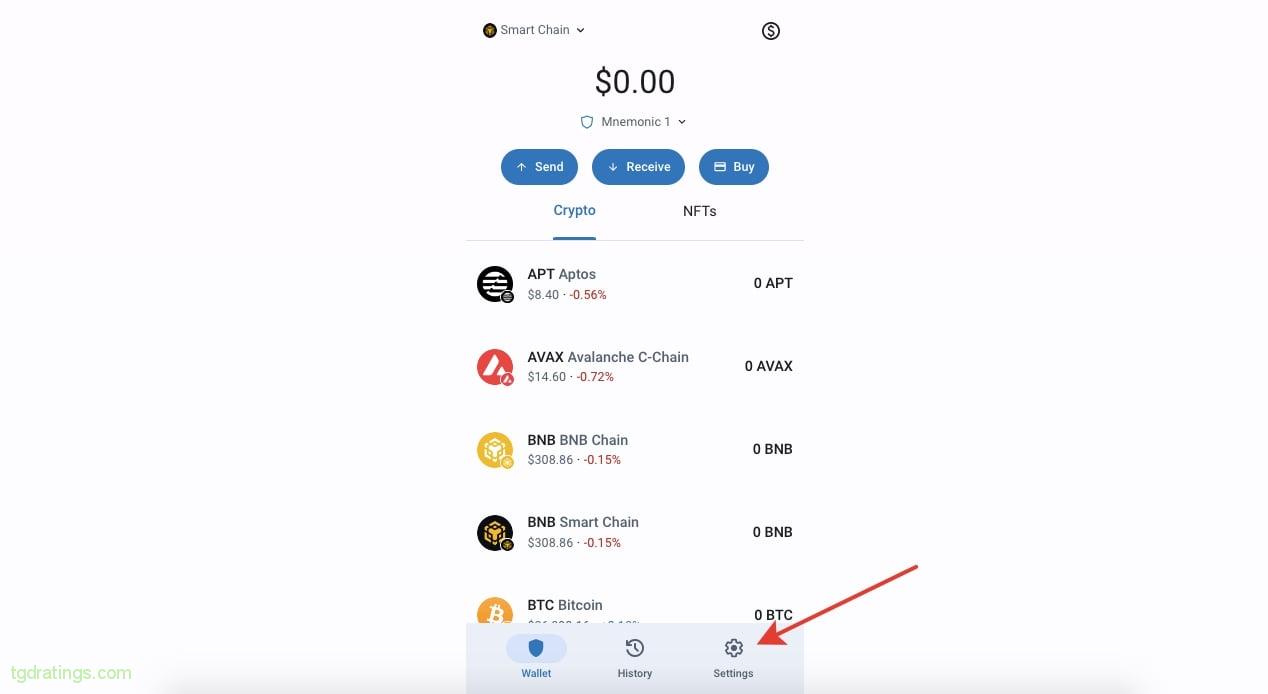

- Go to Trust Wallet (or install it on your computer) and select Settings;

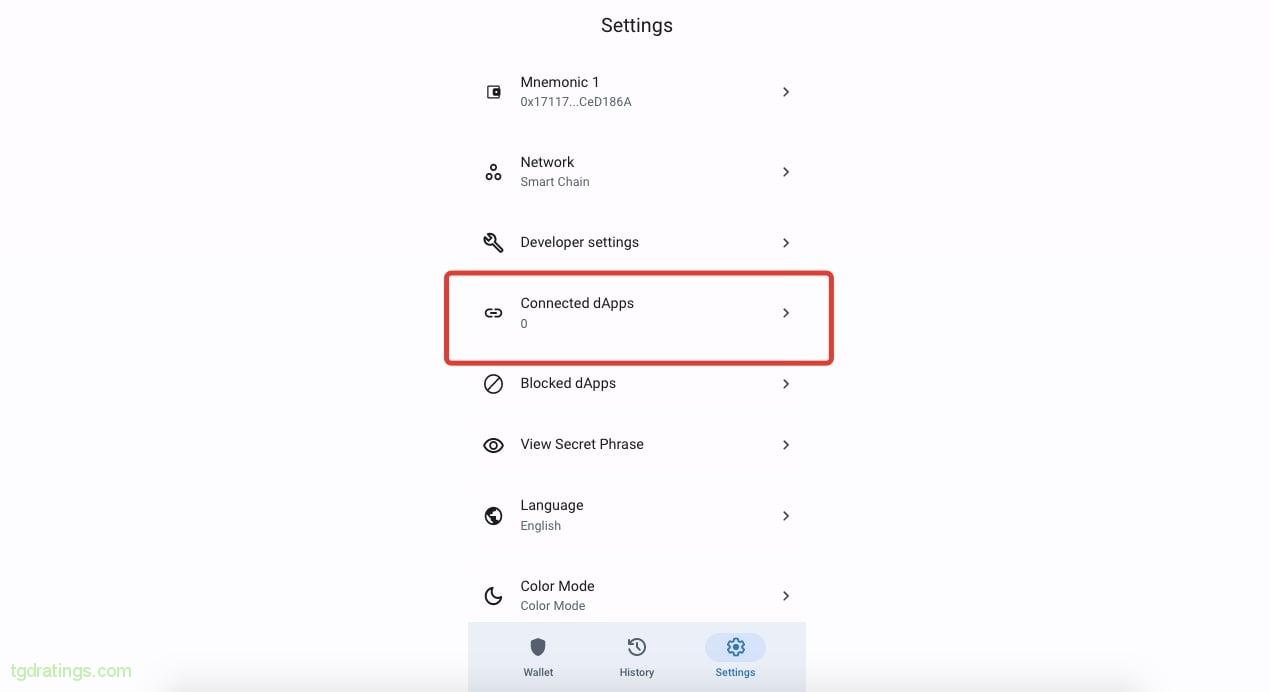

Trust wallet settings - In Settings, select Connected dApps.

Connecting to dApps

Connecting wallet to DEX

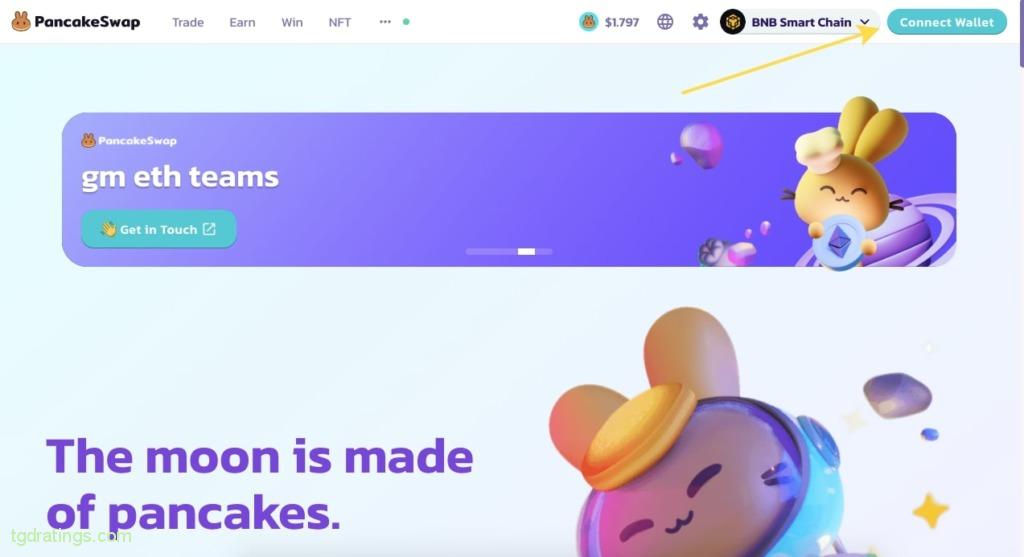

- Go to https://pancakeswap.finance/ (check the address bar, so as not to get on a phishing site). Click the Connect Wallet button in the upper right corner on the exchange website;

Connecting a wallet - Select Trust Wallet and click on the wallet name;

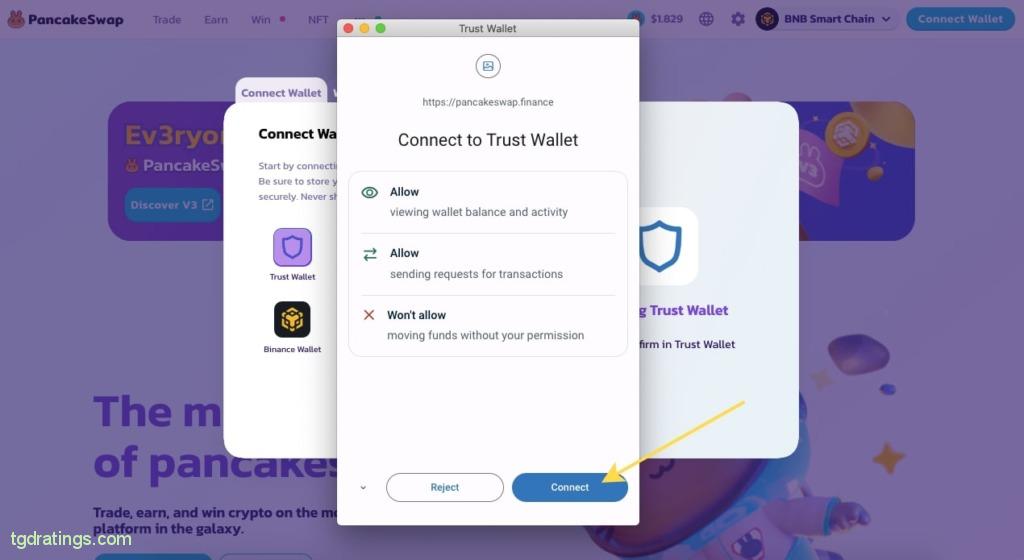

Wallet selection - Click Connect in pop-up window;

Connecting Trust Wallet to Pancakeswap - Go to the exchange website and make sure that your wallet is connected to the platform and displayed on the main page at the top.

An exchange-connected Trust Wallet

First trade making on the DEX

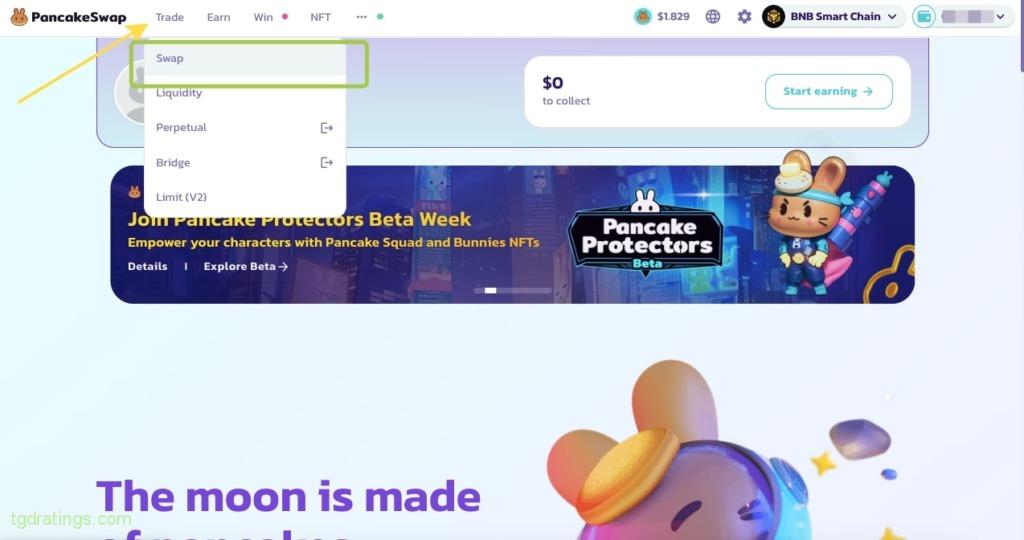

For an exchange operation, select the Trade → Swap tab.

Conclusion

Decentralized exchanges were created much later than centralized exchanges. But they offer new unique solutions that have taken the use of cryptocurrencies to a new level. DEX-exchanges strongly influenced the development of the cryptocurrency industry and, in fact, marked the creation of a separate sector – DeFi (decentralized finance).

When choosing a DEX exchange, pay attention to the following criteria: user interface convenience, liquidity, number of trading pairs supported, fees.

To start working with a decentralized exchange, you do not need to register, verify and make a deposit. It is enough to connect the crypto wallet that you use to the exchange.

FAQ