CoinW Review 2025

Since its creation, the CoinW exchange constantly optimizes its product line and introduces innovative solutions, following new trends in the cryptocurrency industry. The mission of the exchange is “to expand the capabilities of blockchain technology and to help users increase their wealth”.

CoinW users have access to spot and futures trading, ETFs, P2P, and purchasing cryptocurrency from a card. A distinctive feature of the exchange is its focus on altcoins. In addition to trading, users are offered: mining pool, auto-investing, copy trading services, earning programs with flexible and fixed terms, various competitions and bonuses.

For more detailed information about the CoinW crypto exchange, read the review by experts of TGDRatings.com.

What is CoinW?

CoinW is a centralized cryptocurrency exchange founded in 2017. The main feature of the exchange is its focus on altcoins and coins with low capitalization (for example, NEAR, FTT, etc.). The platform supports 350+ cryptocurrencies, traded in pairs with USDT. You can buy and sell coins for fiat on the P2P platform, or using a bank card. According to CMC some coins trading volumes (like JPC or CWT) on CoinW are higher than BTC. This shows strong user interest in altcoins presented on CoinW.

The project cooperates with the largest companies in Chinese business, such as Baidu, Tencent and Alibaba, as well as with Oracle, an American software industry giant.

CoinW reports that it holds multinational financial supervisory licenses and operates in accordance with the legal requirements of those countries.

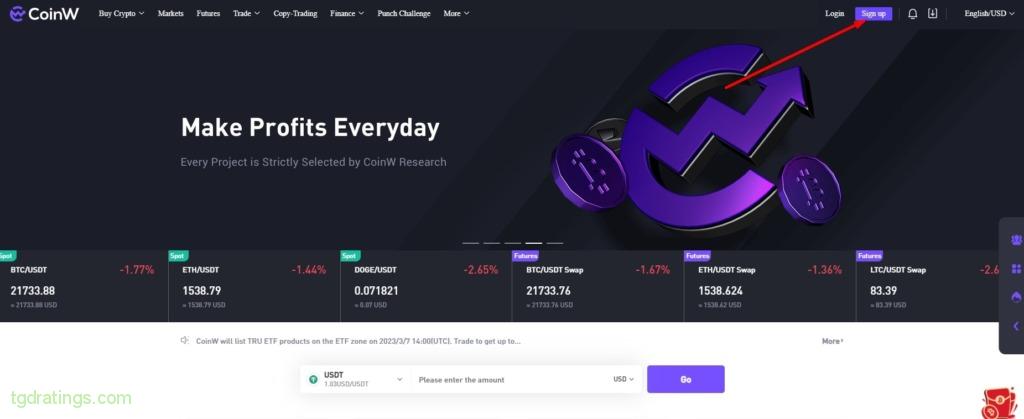

CoinW sign up and verification

To register on the exchange:

- Open CoinW official website;

- Click Sign Up at the top of the main page;

Start registration - Select registration by phone number or with e-mail and fill out the appropriate form: enter your email address, password (confirm your password), confirmation code, referral code (if have one);

- Click Sign Up.

Registration form

After this, the registration process will be ended and you will be redirected to your personal accounton the exchange.

After registration, the new user gets the Unverified status. There some additional verification levels are also available: Primary ID Verification and Advanced ID Verification. The user can gets any of these level by providing personal information to the exchange

Users can deposit and withdraw cryptocurrencies, trade the spot market, ETF market, futures contracts, and invest in various CoinW products without KYC procedures.

The daily withdrawal limit from accounts that have not passed KYC is 0.2 BTC. For accounts that have passed the primary KYC level, 2 BTC per day are available for withdrawal. After the advanced KYC level the limit rises to 100 BTC per day.

Exchange customers cannot use P2P service unless Primary KYC is completed, and cannot use the Super Bonus without completing Advanced KYC.

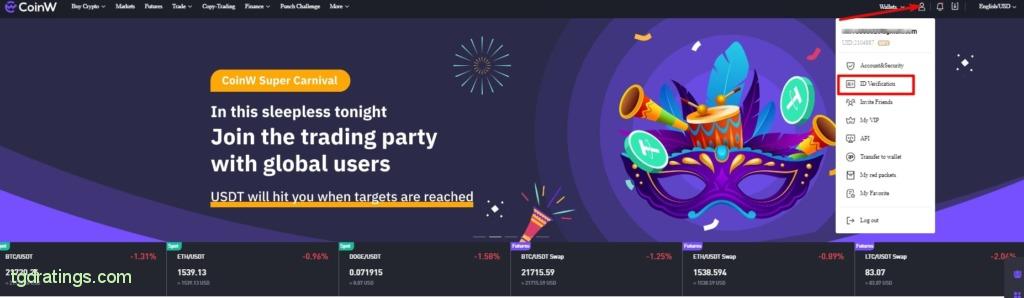

To get verified:

- Click on the profile icon → ID Verification or Account and Security;

Start ID Verification - Click Verify in the ID Verification field;

ID Verification - Select your residency country. ID Verification involves passport verification (for residents of China) and passport and face verification (for residents of other countries);

Primary ID Verification - Upload the relevant documents following the exchange’s instructions.

Account security

To ensure the safety of customer funds, CoinW maintains the following security measures:

- Email address and password when logging into your account;

- Two-Factor Authentication: The company provides customers with the option to add an extra layer of security to their account login process by requiring a security code in addition to their username and password. A security code is a unique, one-time number that you receive in the Google Authenticator app on your mobile device;

- Trading password to confirm the transaction;

- Management of IP-addresses for account access.

To set up two-factor authentication (2FA):

- Install the Google Authenticator application on your phone;

- Click on the profile icon and select Account and Security;

Start security setup - Select Google Authenticator in opened window and click To bind;

Security settings - Scan QR code in the next window using the Google Authenticator app;

- Insert the code that appears in the application and click Confirm.

QR code for linking Google Authenticator

The account is created. What’s next?

After you have completed registration and configured security settings, you need to make a deposit. Let’s look at the methods of depositing and withdrawing funds available on the exchange.

CoinW deposit and withdrawal methods

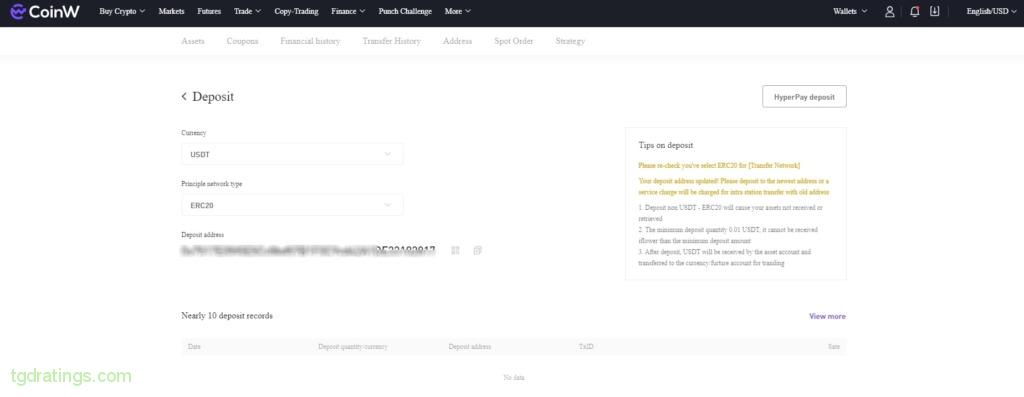

On the exchange you can top up your account with cryptocurrency. You can choose any coin, but we will look at the procedure for replenishing user’s exchange wallet with USDT stablecoin (this is convenient, since all coins on the exchange are traded in pairs with USDT):

- Click Wallets in your personal account, select Deposit;

Start replenishing the deposit - Select USDT as the deposit currency;

- Specify the translation network (ERC20 in our case). Select the same network in the wallet from which you are transferring your coins;

- Copy the received address and paste it into your wallet;

Address for depositing USDT - Complete the transaction in your wallet and check the receipt of coins in your account.

To withdraw funds:

- Click Wallets → Withdraw;

Start withdrawal - Fill out the withdrawal form: cryptocurrency, network, amount, withdrawal address;

- Click Withdraw.

CoinW trading conditions and tools

CoinW offers a large number of tools for cryptocurrency trading, including buying coins with a card, spot and futures markets, ETFs, P2P. However, the platform does not offer crypto-fiat trading pairs, which may be a drawback for some traders.

CoinW does not charge fees for deposit replenishment, and trading feesdepend on the market and trading volume.

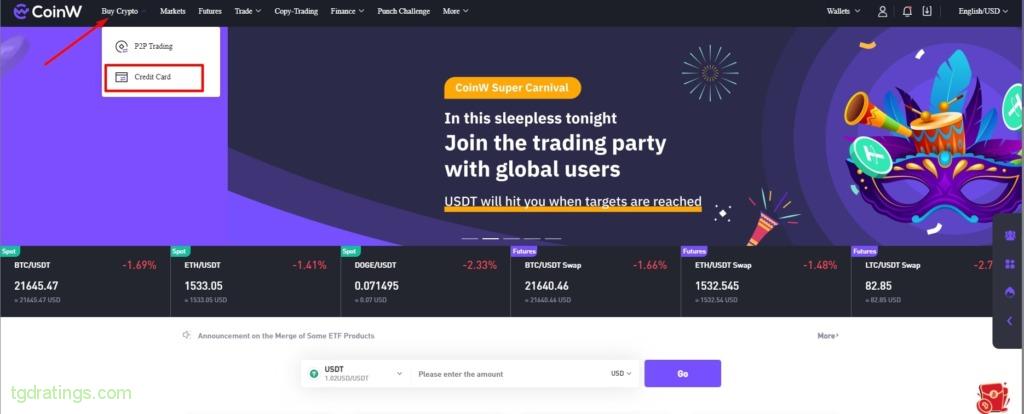

Buy crypto (Fiat)

One can purchase cryptocurrency for fiat on CoinW using Buy Crypto service. It provides an option to exchange USD, EUR, KZT, PLN, etc to crypto with a bank card.

To buy cryptocurrency (such as USDT) with fiat:

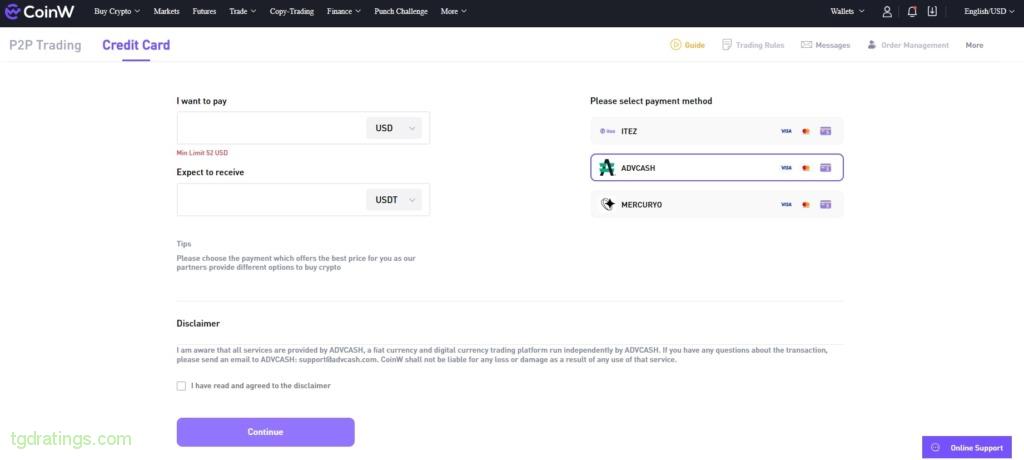

- Select Buy Crypto in the main menu → Credit Card;

Start purchasing USDT with a card - Fill out the form: select the currency you will pay with (in our case, USD) and enter the amount;

- Select a payment system (for example, ADVCASH). After this, the exchange will automatically calculate how much USDT you will receive. Or you can specify the amount of USDT to purchase, and the exchange will calculate how much USD you have to pay;

- After filling in all the data, click Continue;

Buying cryptocurrency with a card - Then you will be redirected to the payment page, where you have to enter card details and confirm the payment by clicking Pay.

Card data filling form

Spot market

Spot trading is the purchase/sale of assets at the current market rate with immediate delivery of the asset from the seller to the buyer (or reverse). Spot trading on the exchange takes place in the trading terminal.

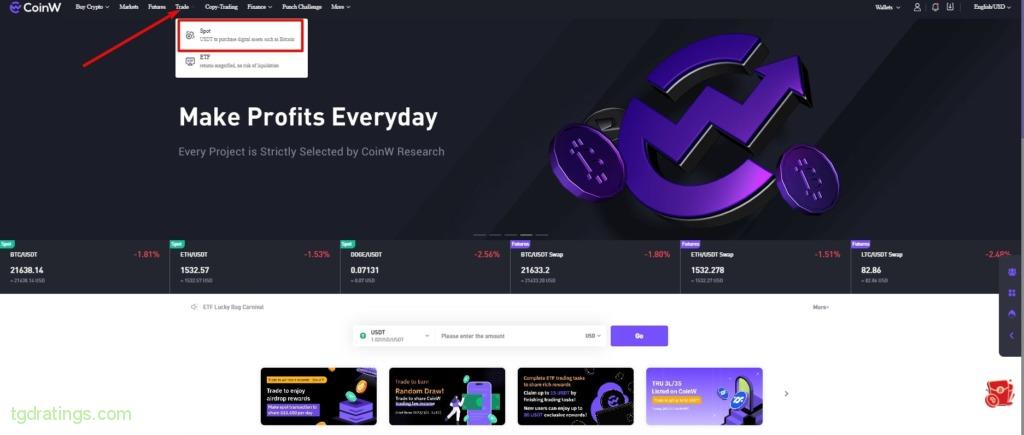

The CoinW spot market trading terminal is available in the Trade → Spot tab.

The terminal provides the next order types customer can use for trading: Limit order, Market order, Grid Trading (a trading bot automatically buys and sells cryptocurrency on the spot market, with orders placed in specified intervals and price ranges).

Crypto futures

Futures contract is a type of derivative contracts. They represent an agreement between a buyer and a seller to sell an asset at a future date on pre-agreed conditions.

For example, if you buy BTC with USDT on the spot market, the BTC you purchased will appear in the list of assets in your account, which means you already own and hold BTC. In the futures market, if you go long BTC/USDT, the BTC you buy will not show up in your futures account: only the position will be shown, meaning you have the right to sell BTC in the future

Leverage makes contract trading capital efficient: you may only invest a small portion of BTC to open a contract position for a whole BTC. The maximum leverage on the CoinW exchange is 200x.

Futures terminal on CoinW is available in the Futures tab.

On futures market the exchange users can open Market, Limit, Trigger orders.

P2P

In peer-to-peer (P2P) trading service, users directly interact with each other to buy and sell cryptocurrency without the participation of a third party. To work on P2P marketplace the user needs to go through registration and verification process. After this you can use the service.

Escrow service on the CoinW P2P platform ensures that cryptocurrency will only be available after the buyer pays the required amount of coins to seller.

This type of trading is available in the Buy Crypto tab → P2P.

ETFs

The CoinW ETF is similar to leveraged products in traditional markets that track the specific daily rise and fall of a target asset. Users do not need to pay for collateral assets to achieve the effects of leveraged trading on target assets.

Unlike leveraged trading or futures contracts, users do not require collateral. However, this product has strong price fluctuations, so you need to take the risks into account.

CoinW ETF Products contain:

- Multi-currency ETF products;

- ETF products with currency margin;

- High multiple ETF product (up to X6 leverage).

Exchange-traded funds are available in the Trade → EFT tab.

Fees and limits

CoinW currently charges 0.2% fees for spot makers and takers .

In general CoinW trading fees are based on a tiered system, where the percentage of the fee depends on the amount of the CWT token user has. Initially, both makers and takers pay a fee of 0.2% for each transaction. The lowest commission of 0.01% is available to traders who have 86,800 CWT (the exchange’s internal token) in their account within a 30-day period. But there are some special conditions for other trading actions.

For example, the fees for a spot order executed by a bot is 0.1% for makers and takers. And the level of trading fees for futures trading is set up at 0.04% for makers and 0.06% for takers.

Withdrawal fee depends on the coin and network. So, for BTC withdrawal you need to pay 0.001 BTC, for ETH withdrawal – 0.00135131 ETH, for LTC withdrawal – 0.019 LTC. The commission amount may vary depending on network load.

How to trade on the CoinW cryptocurrency exchange

To buy and sell cryptocurrency through the terminal:

- Open the Trade → Spot tab;

Spot market - The trading terminal window opens. By default you will be offered to trade BTC/USDT trading pair. One can select the desired trading pair on the left side of trading terminal interface or using the search bar;

Selecting a trading pair - Select order type (for example, Market);

- Specify the amount of coins you want to spend on BTC buying;

- Click Buy BTC.

Buying BTC on the spot market

Selling on the spot market is not much different from buying, except that you fill out a sell order (on the right side of the screen). There you have to specify the amount of coins to sell and click Sell BTC.

Additional CoinW services

Besides trading, the exchange provides additional services for earning money: CoinW Earn, automatic investing, copy trading, mining pool, CoinW Launchpad, venture investments, daily traders tournament.

CoinW Earn

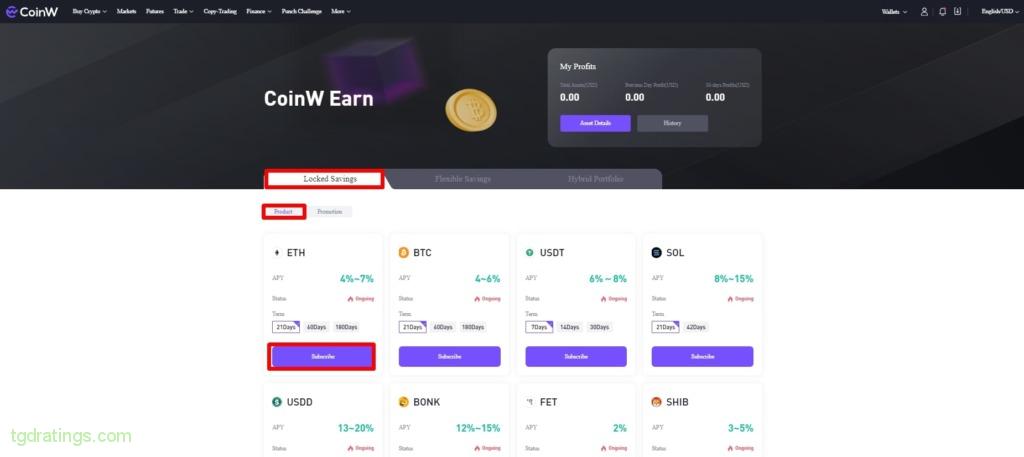

CoinW Earn allows you to earn money by holding cryptocurrency. Products are available with both fixed and flexible locking. The annual interest rate ranges from 1% to 20% and depends on the currency and lock-in period (for fixed lock-in products). Available roducts are divided into regular and promotional. Annual interest rates for promotional products are lower than for regular products. CoinW is constantly adding new coins.

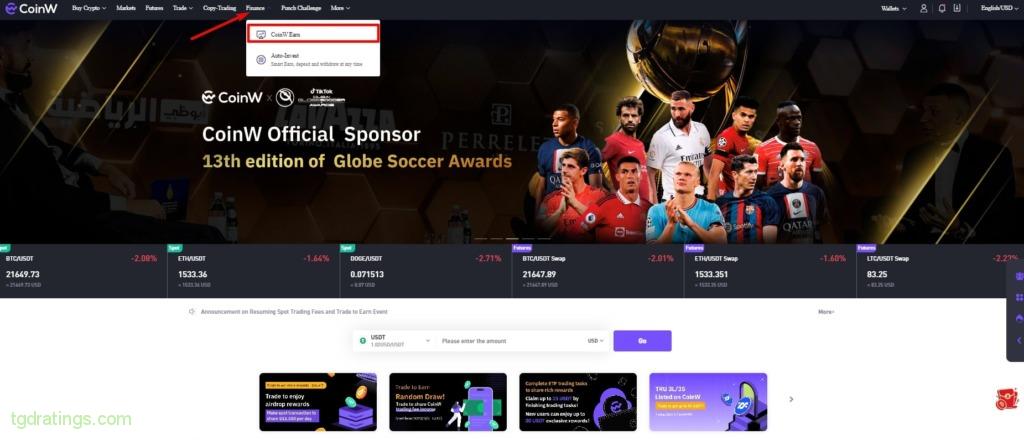

To participate in CoinW Earn:

- Choose Finance tab and click CoinW Earn;

CoinW Earn - Select the type of earnings: Locked Saving, Flexible Saving, Hybrid Portfolio. Let’s choose Locked Saving as an example;

Selecting product type - Click Product or Promotion (Product in our case);

- Select a coin (ETH in our case ) and click Subscribe.

Participation in earning CoinW Earn

Automatic investment

CoinW Auto-Invest is a service where the user can automatically invest in cryptocurrencies and receive passive income.

CoinW Auto-Invest, also known as dollar cost averaging, is an investment strategy where a fixed amount of an asset is purchased every month or every quarter. CoinW Auto-Invest has a fully automated mechanism and is suitable for busy people.

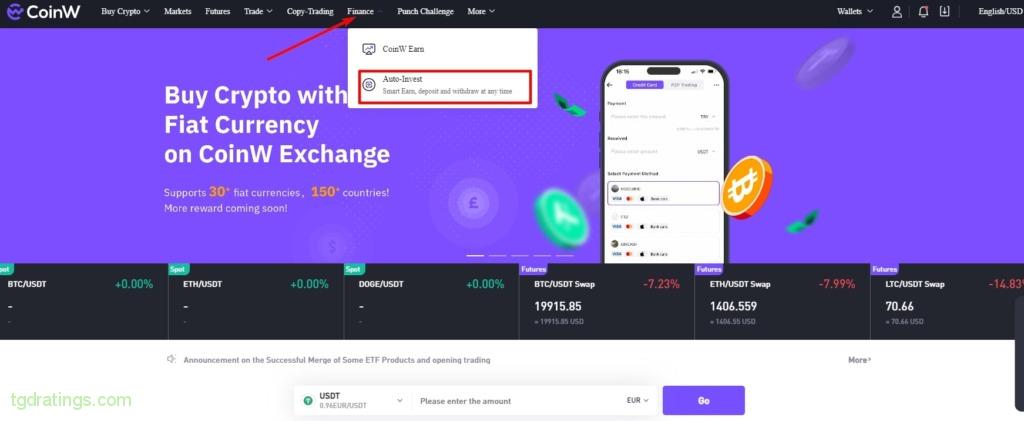

To create an investment plan with auto-invest:

- Open the Finance → Auto-Invest tab;

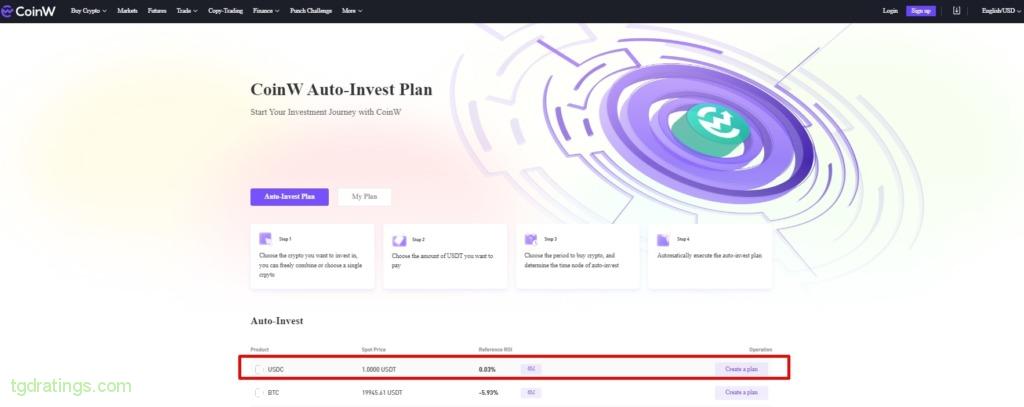

Selecting auto-investment - Select a cryptocurrency to invest in (for example, USDC) and click Create a Plan;

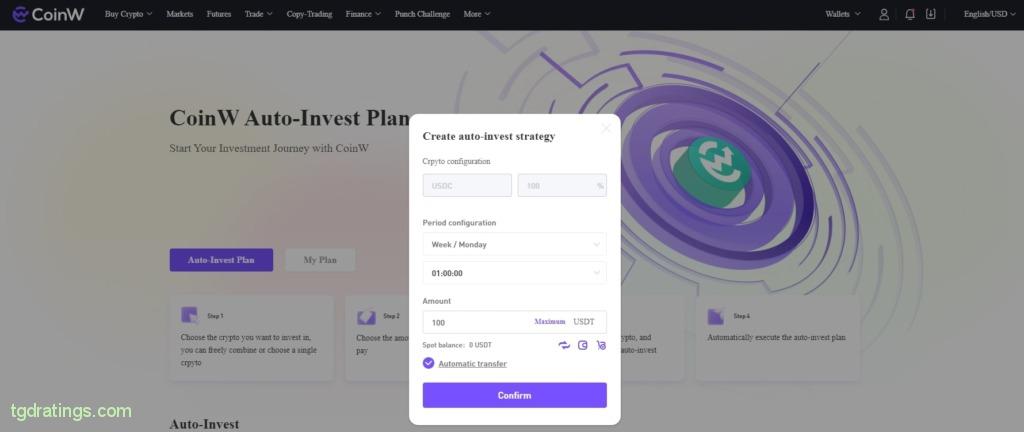

Select of cryptocurrency for auto-investment - Select period for purchasing cryptocurrency, USDT amount for payment and auto-investment period;

- Check the plan and confirm it by clicking Confirm.

Creating an investment strategy

Cryptocurrency purchased through Auto-Invest will automatically be credited to your account and you can withdraw it at any time.

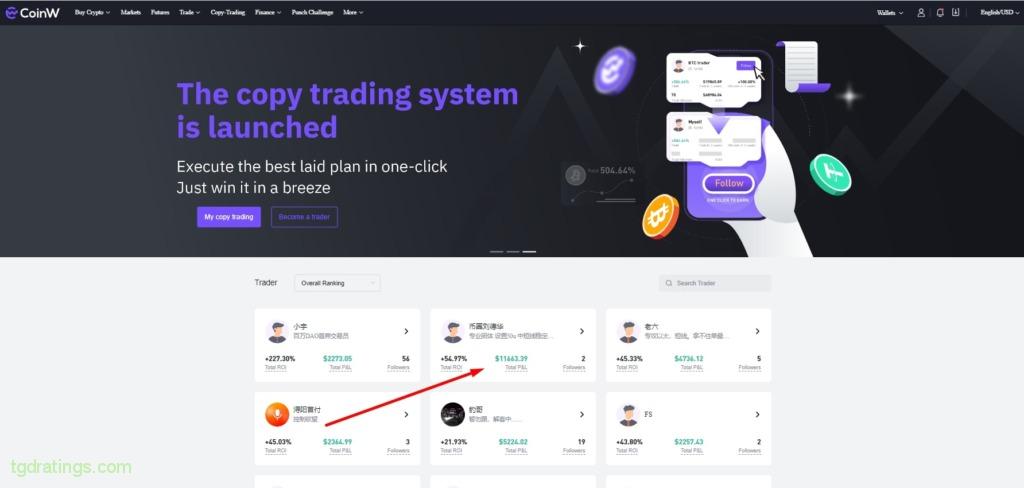

Copytrading

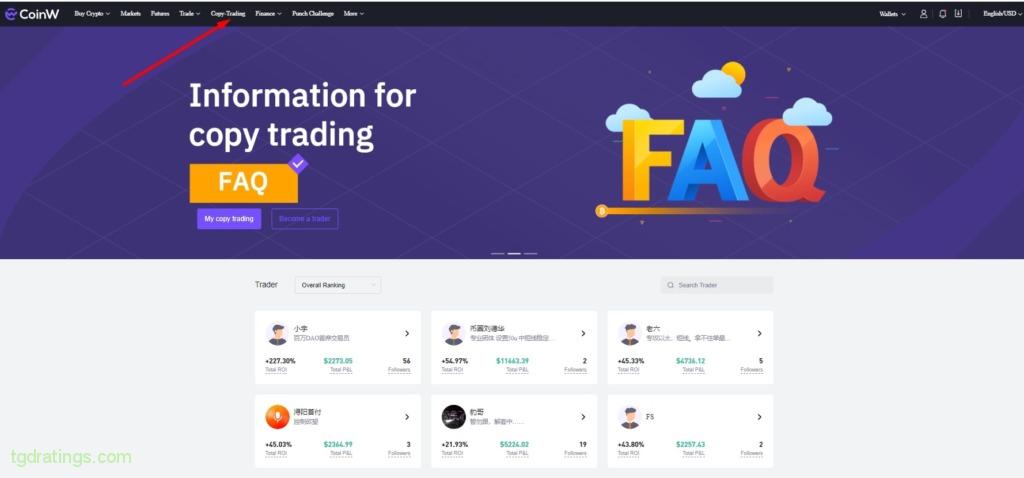

In August 2022, CoinW launched a copy contract trading system, allowing users to follow the trades of successful traders on the platform. Exchange users can copy all transactions of master traders.

Unlike the traditional copy trading mode, CoinW Contract has developed a one-click copy feature. After selecting a professional trader, the user follows him to open and close positions simultaneously, without having to monitor the market for 24 hours.

Users can see detailed information about each trader, includingoverall trader rating, 7-day profit and loss report, 7-day ROI, 3-week payback, 3-week profit and loss report, number of users copying trader’s trades, current market value assets under managementetc.

CoinW allows users to track the positions of several traders simultaneously and does not place a limit on the number of copies. Moreover, for the same currency, users can freely select multiple traders to copy. Copying trades from different traders does not affect each other. By following a trader, you can also trade futures on your own. User can cancel copying transactions at any time.

Traders and users who copy their trades can freely choose cross-margin or isolated marginmode. Even when professional traders choose cross-margin mode, copiers may choose isolated margin mode.

To start copy trading:

- Click Copy-Trading string in the menu on the main page of the exchange;

Copy Trading - Select a trader after studying information about his trading style;

Choosing a trader - Click the Follow button;

Trader information - Read the terms of use and risks and click Confirm Following;

Terms of use - Specify the necessary settings (for example, trading pairs you want to monitor, position type, leverage, deposit for copying, etc.) and click Save;

Copy settings - After this you can start copy trading.

Liquidity Pool

CoinW Shared Mining Pool is a specific mining model the exchange uses. CoinW Shared Mining Pool brings together the main mining pools, mining farms and miners to enable interaction between participants and profit from mining.

Services are provided to individual users and professional mining pools. You can start mining in a pool in one click.

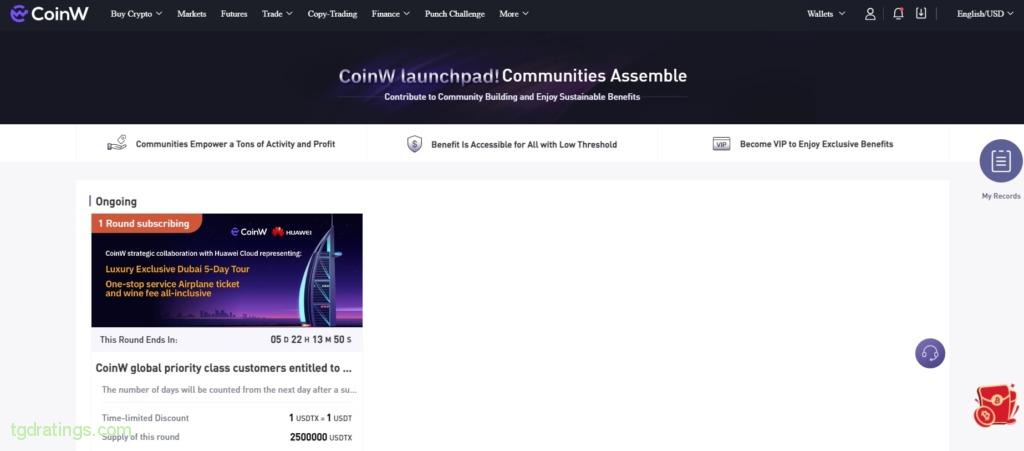

CoinW Launchpad

CoinW LaunchPad is a platform for IEO. Crypto projects are looking for investment for launch and development, and investors are participating in early token sales. This is one of the biggest benefits of launching a token sale on exchanges.

To participate launchpad users must complete KYC. To start subscription to the new currency IEO go More in the main page menu → Launchpad.

Venture investments

CoinW Ventures is a venture capital company founded in 2020. The firm focused on investing in new projects in Gamefi, NFT, Web3, DeFi spheres.

Users can invest in CoinW Ventures regardless of activity level or trading volume. Long-term large investments are discussed individually.

An analysis of new CoinW projects is presented in the section Research CoinW.

Daily trading tournament

The exchange provides the opportunity to participate in daily trader tournaments and receive prizes.

CoinW app

The exchange has an application on Android and iOS. You can download the application from Google Play, App Store and on official website.

CoinW reviews

Even though CoinW launched earlier than some industry giants, the exchange is relatively unknown. CoinW doesn’t have many independent reviews and testimonials.

Positive feedback about the exchange features:

- Stable work;

- An option to trade on the futures market and ETFs;

- Low trading commissions – from 0.2% to 0.01%;

- Good referral program, many competitions and promos with prizes;

- A lot of tools for additional earnings (savings program, mining pool, referral program, etc.).

Negative feedback:

- Small trading volumes;

- There are no license documents and clear information about the exchange an its team on the site;

- Site freezes.

CoinW pros and cons

FAQ

- Open the official CoinW website;

- Click Sign Upon the main page;

- Select registration by phone number or e-mail;

- Fill out the registration form;

- Click Sign Up.

- Click Wallets → Deposit;

- Select USDT as the deposit currency;

- Specify the network (for example, ERC20). The same network will need to be selected in the wallet from which you are replenishing the deposit;

- Copy the received address and paste it into the sending wallet;

- Check the receipt of coins to your account.

Futures trading fees: 0.04% for makers and 0.06% for takers.

Withdrawal fee depends on the coin and network: for example, for BTC withdrawal you need to pay 0.001 BTC, for ETH - 0.00135131 ETH, for LTC - 0.019 LTC.

Conclusion

CoinW was founded in 2017. The exchange lists only crypto assets that have been verified by a special team of analysts. CoinW currently supports 350+ cryptocurrencies, and the number continues to grow.

In terms of trading options, CoinW offers spot, futures, ETFs and P2P markets. In addition to the main types of services, the exchange provides additional earnings programs and services: liquidity pool, savings programs with fixed and flexible locking periods, copy trading, auto investing, referral program, promotions and bonuses, etc.