- 1. Binance

- 2. Kucoin

- 3. Commissions

- 4. Key Features

- 5. Binance Features

- 6. Kucoin Features

- 7. Trading pairs

- 8. Verification Requirements

- 9. Security

- 10. Staking

- 11. The main differences between Binance and Kucoin

- 12. FAQ

Binance vs. Kucoin: Which Should You Choose?

One of the most important steps for a novice crypto investor or trader is to choose the right cryptocurrency exchange. The platform should be user-friendly, functional, meet security requirements and to offer low commissions and high limits.

Due to the large number of trading platforms, it is difficult to make a choice. In such conditions, it is most convenient to compare exchanges in pairs. In the new article, TGDRating.com experts studied and compared the features of two exchanges from the world’s top 10 – Binance and Kucoin.

Binance

Binance is the largest cryptocurrency exchange in the world and the leader in daily trading volume on the spot market. Binance is also considered one of the best platforms in terms of the number of tools for additional income: staking, deposits, loans and so on are available.

- Foundation year: 2017;

- Founders: Changpeng Zhao (also known as CZ) and Yi He;

- Verification: required;

- Trading pairs: 1400+;

- Available markets: spot, margin and derivatives (futures, options), P2P, OTC;

- Trading fees: up to 0,1%.

Kucoin

Kucoin is a large cryptocurrency exchange based in Hong Kong. It features a large number of altcoins (700+ coins), which are traded on the spot, margin and futures markets.

- Foundation year: 2017;

- Founders: Michael Gan and Eric Don;

- Verification: optional;

- Trading pairs: 1200+;

- Available markets: spot, margin and futures, P2P;

- Trading fees: up to 0,1%.

Commissions

With active trading on the exchange, commissions can strongly affect earnings. For this reason, exchange commissions are one of the main factors when choosing a platform.

Binance Fees

Trading fees:

- The fees grid on Binance is divided into 9 tiers based on account trading volume over the last 30 days (calculated in BUSD or BNB) or BNB balance. Separate grids are valid for spot trading (maker/taker – from 0.1/0.1% to 0.02/0.04%), futures trading (maker/ taker – from 0,02/0,04% to 0,00/0,017%), options (maker/taker – 0,02/0,02%) and margin borrowing (depends on the cryptocurrency).

Binance trading fees - When using BNB to pay trading commissions, there is a discount up to 25% (on spot) and 10% (on futures);

- From summer 2022, zero trading fees apply on the Binance spot market for the following pairs: BTC/AUD, BTC/BIDR, BTC/BRL, BTC/BUSD, BTC/EUR, BTC/ GBP, BTC/RUB, BTC/TRY, BTC/TUSD, BTC/UAH, BTC/USDP and BTC/USDT;

- Zero commissions also apply for makers of any level in pairs with BUSD.

Commissions for deposits/withdrawals.

Commissions are not charged when one replenishing an account with cryptocurrency, but charged on withdrawing – the amount depends on the withdrawn cryptocurrency.

Binance supports account replenishment in many ways: by cryptocurrency purchasing with debit/credit cards (commissions 1,8%), by third-party services such as Simplex and Banxa (commissions from 2% and above), P2P services (the commision is paid by maker and depends on the currency), SWIFT and SEPA transfers (commissions vary depending on the user’s country and currencyЖ for EEC countries from 0 euros and above).

Kucoin fees

Trading fees:

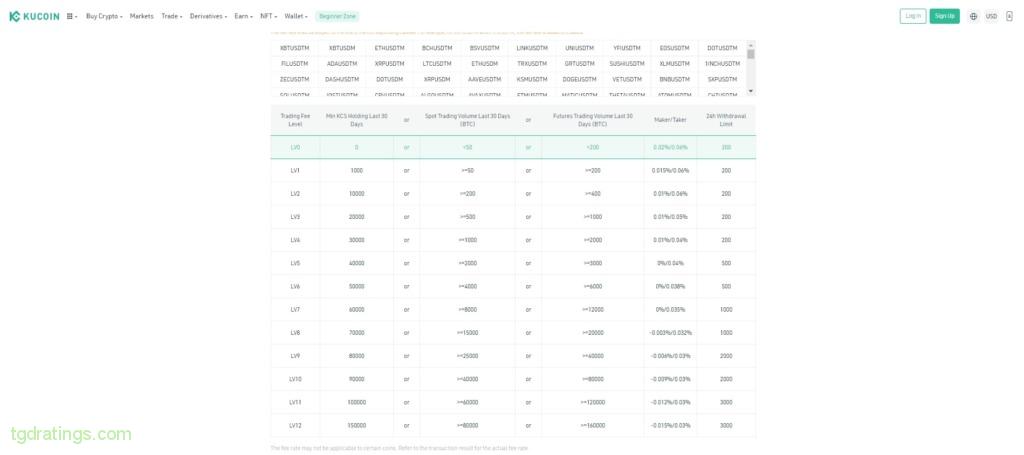

- The fees grid on Kucoin is divided into 12 tiers based on account trading volume for the last 30 days (calculated separately for spot and futures accounts) or amount of KCS on the user’s balance. Separate grids are valid for spot trading (maker/taker for class A currencies – from 0,1/0,1% to -0,005/0,0254%) and futures trading (maker/taker – from 0,02/0,06% to -0,015/0,03%);

Kucoin trading fees - For spot and futures trading, there is also a division into classes of cryptocurrency pairs: the lower the class of the pair, the higher the commission with this pair. Maximum pf commissions in A class pairs (for taker and maker) – 0,1%, class B – 0,2%, class C – 0,3%;

- When using KCS to pay trading fees, there is a discount up to 20% on spot.

Commissions for deposits/withdrawals.

When replenishing an account with cryptocurrency commissions are not charged, when funds are withdrawn – its amount depends on the withdrawn cryptocurrency.

Kucoin also supports account replenishment with the purchase of cryptocurrency by debit/credit cards (commissions from 4.5%), third-part services like Simplex (commissions depend on the service: 4-25%) and P2P services (no exchange commissions).

Comparison table of Binance and Kucoin fees

| Fees | Binance | Kucoin |

|---|---|---|

| Deposit/Withdraw fiat by card | 1,8%; | 4,5%; |

| Fiat top-up via a third-party EPS | For USD: Simplex – 2,5% (for the EEA countries) and 3,5% (for other countries); Banxa – 1,99%; |

For USD: Simplex – 3%; Banxa – 5,25%; |

| Fiat top-up by bank transfer | 0 – 1 euro (depending on the user’s currency and country of residence); | 1,55% (Wire, ACH); |

| Crypto replenishment | 0%; | 0%; |

| Spot trading fee | 0,02% – 0,1% for makers and 0,04% – 0,1% for takers (25% discount when paying in BNB);

0% for BUSD pairs and individual fiat/BTC and stablecoin/BTC pairs; |

A-class pairs: 0,025% – 0,1% for makers and -0,005% – 0,1% for takers (20% discount when paying in KCS); B-class pairs: -0,005% – 0,2% for makers and -0,005% – 0,2% for takers (20% discount when paying in KCS); C-class pairs: -0,005% – 0,3% for makers and 0,075% – 0,3% for takers (20% discount when paying in KCS); |

| Derivatives trading fee | USDⓈ-M Futures – 0,02% for makers and 0,04% for takers (10% discount when paying in BNB), COIN-M Futures – 0,01% for makers and 0,05% for takers; | For all types of futures – 0,02% for makers, and 0,06% for takers; |

| P2P trading | Fee is charged from the maker (not charged from the taker). Commission rates depend on the coin (for example, for USD – 0,35%, for EUR – 0%); | No fee charged; |

| Options trading | 0,02% for regular users. 0% for VIP makers and 0,015% for VIP takers; | Not supported; |

| Swap farming | 0,02% for regular users. 0% for VIP makers and 0,015% for VIP takers; | Not supported; |

| Staking fee | Not charged; | Not charged; |

| Mining fee | Binance Pool commission rate is 2,5% (VIP users can use the reduced rates). | No information. |

Key Features

Let’s consider the main trading opportunities Binance and Kucoin provide.

Binance Features

Binance ranks first in the world in terms of daily trading volume on the spot market. Spot, margin, futures (USDS-M and Сoin-M futures with leverage up to x125) and option trading (European style options) are available on the exchange . Among the tools available are also P2P-platform and OTC service.

Binance supports crypto/fiat spot trading for 15 fiat currencies, including USD, EUR, GBP, TRY, PLN and more.

Kucoin Features

Kucoin is the top ten cryptocurrency exchanges by daily trading volume. The exchange provides access to spot, margin and futures markets (futures USDS-M in USDT and Сoin-M, leverage – up to x100). The P2P-servive is available too.

Arbitrage Portfolios are dedicated to a separate service on Kucoin, which allows you to earn on the financing of arbitrage transactions between the spot and futures markets of the exchange.

Kucoin, like Binance, supports trading in crypto/fiat pairs, but on the Kucoin spot market there are only BRL pairs: USDT/BRL, BTC/BRL and EHT/BRL.

Trading pairs

The number of trading pairs on the exchange determines the range of possible projects, which coins can be traded by trader or investor can accumulate.

Trading pairs on Binance

Binance has 300+ coins and 1400+ trading pairs. Fiat trading pairs are also available: USD, EUR, GBP, AUD and other currencies. In general, Binance is more strict about the selection of tradable assets than Kucoin.

Trading pairs on Kucoin

Kucoin has 700+ coins and 1200+ trading pairs. Fiat (Brazilian real) trading pairs are also available: BTC/BRL, ETH/BRL, USDT/BRL. Kucoin is more liberal towards new and promising coins than Binance.

Verification Requirements

Verification helps to strengthen the account security, provides access to the full functionality of the exchange, increased limits and helps to fight against fraudsters. Let’s take a look at the KYC requirements of Binance and Kucoin.

Binance verification requirements

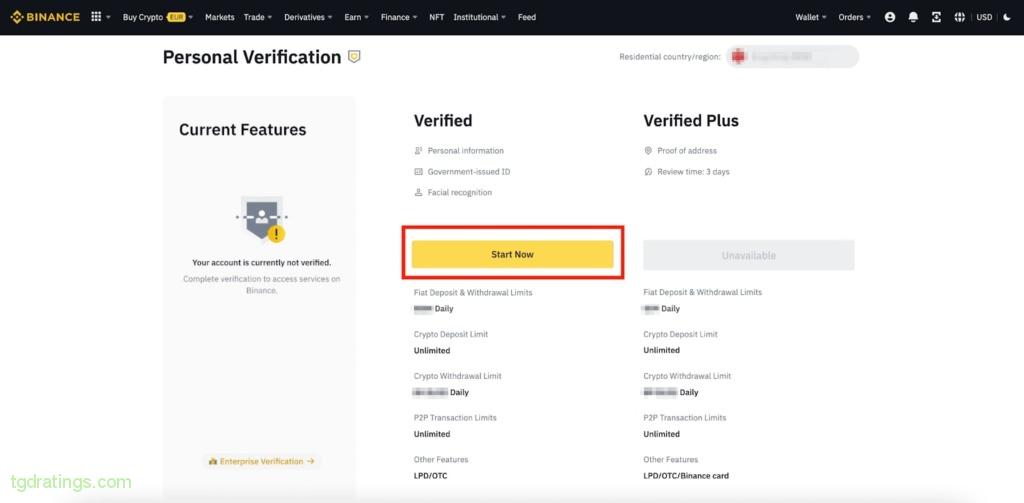

Registering by phone or email gives you Trial access to Binance. So a new user cannot trade and replenish the account balance on the exchange – for this you need to pass an identity verification (verification on Binance is required). Further, an individual user can choose two verification options: Verified and Verified Plus (available only after passing Verified level).

- Verified: it is necessary to provide personal data, identity card (optional: passport, id-card, driver’s license, residence permit), pass the facial recognition procedure. The Verified verification level gives access to the most of the exchange services and increases the withdrawal limits;

- Verified Plus: you must provide proof of residence. The Verified Plus verification level increases the limits and allows you to get a Binance card.

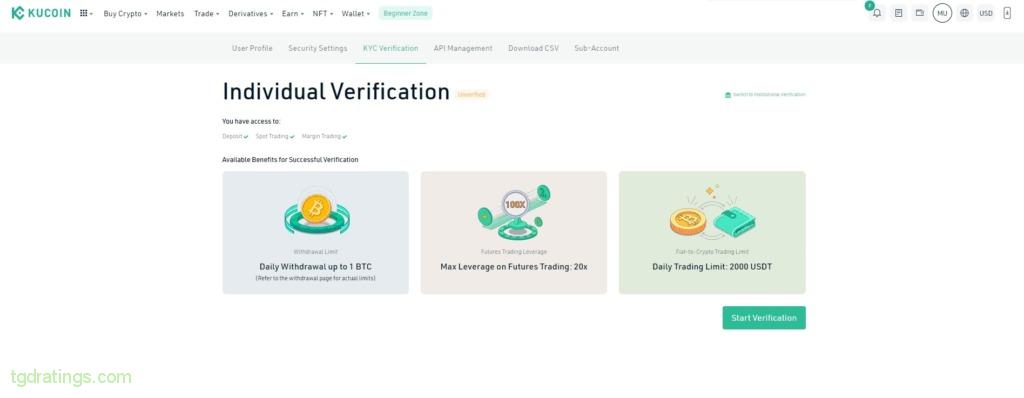

Kucoin verification requirements

Unlike Binance, when registering by phone or email on Kucoin, a new user gets access to a depositing cryptocurrency, as well as spot, margin and futures trading. Verification on Kucoin is optional.

There are three levels of verification for individuals on Kucoin:

- Unverified. The user receives this level when registering by phone or mail. Allows you to deposit and withdraw crypto (up to 1 BTC/day), gives you access to spot, margin and futures markets (leverage up to x5) and P2P platform (trading limit 400 USDT/day);

- KYC 1. To obtain this level, you must provide: full name, ID number and type, country of residence. After verification, the limits for trading on the P2P platform (2000 USDT/day) are increased, as well as the possibility to use leverage up to x20 on futures;

- KYC 2. To obtain the last level, you must provide documents confirming the user’s place of residence. After passing the verification, the limits for depositing and withdrawing cryptocurrencies become wider(up to 200 BTC/day), user gets access to trading on the P2P platform (up to 500 thousand USDT/day), and leverage on futures are increased (up to x100). The user gets full access to platform tools.

Security

Security is one of the most important factors influencing the choice of a trading platform. Both Binance and Kucoin have been subject to successful hacks in the past. Both exchanges have reimbursed users stolen assets and continue to improve their security systems.

Binance Security and Regulation

Binance is ISO/IEC 27001 (Information Security Management) certified by Classification Society DNV GL and UKAS. In addition, there are various account security settings in the personal account of the exchange.

Available account security settings on Binance:

- Biometric authentication;

- Connection of external hardware security keys;

- Binance/Google Verification;

- Verification by phone number and email;

- Login/password;

- Manage external accounts and devices;

- White addresses for withdrawal and restrictions on the withdrawal of cryptocurrency;

- Anti-phishing code.

Kucoin security and regulation

Kucoin also takes security issues seriously. So far, the exchange does not have certificates received from regulators. However, the platform has been verified by the Cypriot exchange regulator CySEC and the British financial regulator FCA and has official permission to operate in these countries. In addition, Kucoin also offers a wide range of account security settings.

Available Kucoin account security settings:

- Verification by phone number and email;

- Google Verification;

- Login/password;

- Trading password;

- IP, external accounts and device management;

- Anti-phishing codes in emails, on login and withdrawals;

- White addresses list;

- Freezing and deleting an account.

Staking

Staking is one of the most popular ways to earn extra money on cryptocurrency. By process it is similar to a bank deposit: the user deposits cryptocurrency to the account for a certain period and receives a percentage reward. The deposit body is secured and in any case will be returned in full.

Staking on Binance

Binance offers the following types of staking:

- Ethereum 2.0 staking – staking into the transitional coin BETH of the Ethereum network with a variable rate. As the max rate Binance recommends targeting 11.2% per annum;

- DeFi Staking – staking in reliable cryptocurrency projects. Terms: flexible or up to 120 days (in some cases, the exchange offers longer terms). Profitability: up to 50%.

Staking on Kucoin

Kucoin staking offers include:

- Kucoin Earn Service – staking and other types of investments in popular and promising cryptocurrencies. Terms: flexible or up to 1 year. Profitability: up to 50% and above on promising cryptocurrencies or other coins (for example, GEM);

- Ethereum 2.0 Staking – staking into the transitional coin BETH of the Ethereum network with a variable rate. As an average rate Kucoin recommends targeting 4.43% per annum.

The main differences between Binance and Kucoin

| Binance | Kucoin | |

|---|---|---|

| Foundation year | 2017 | 2017 |

| License | yes | none |

| Verification | Required | Optional |

| Number of trading pairs | 1400+ | 1200+ |

| Fiat pairs | yes | yes (BRL) |

| Available Markets | Spot, derivatives, purchase by card, P2P, OTC, margin trading, NFT | Spot, futures, purchase by card, P2P, margin trading, NFT |

| Spot Trading Commission | from 0,1% for all participants (or 0,075% if paid in BNB); Zero commission on BUSD pairs and selected BTC/Fiat and BTC/stablecoin pairs |

Depends on the trading pair class: A-class: from 0,1% for all participants (from 0,08% when paying fees in KCS); B-class: from 0,2% for all participants (from 0,016% when paying fees in KCS); C-class: from 0,3% for all participants (from 0,024% when paying fees in KCS) |

| Staking | DeFi staking with fixed and flexible locking | DeFi staking with fixed and flexible locking |

| Crypto wallet | Trust Wallet | Kucoin Wallet |

| Additional Services | Cryptocurrency swap, liquidity farming, crypto loans, Launchpad, bi-currency investments, autoinvestment, Binance Pool, Binance Pay, ETH 2.0, etc. | Cryptocurrency swap, crypto loans, bi-currency investments, Launchpad, auctions, staking, ETH 2.0, trading robots, etc. |

| Security settings | 2FA, phone binding, SMS notifications, withdrawal whitelist, anti-phishing code, etc. | 2FA, phone binding, SMS notifications, trading password, anti-phishing codes, white IPs list, etc. |

| Exchange Hacks | yes | yes |

| Coingecko rating | 10/10 | 10/10 |

FAQ

Both exchanges were hacked, but all funds were returned to users. Binance has 60 billion of its own funds that can be used for emergency funding, while Kucoin has 2 billion. Binance has a ISO/IEC 27001 (2019) Information Security Management Certification, Kucoin does not, but the exchange is regulated by CySEC and FCA.

The choice of the exchange in this case is the decision of the user.

On futures at the basic level, Binance is more advantageous than Kucoin, at least for takers - 0,4% versus 0,6%. The maker fees on futures are the same at the base level for both exchanges

Kucoin is an option for those who trade small amounts of cryptocurrency (no KYC needed) and use passive income tools in moderation.