USDC vs. USDT: Comparing Stablecoins 2025

Since the appearence of cryptocurrency and to this day, new projects and technological solutions are constantly emerging in the crypto industry. The creation of stablecoins is one of the innovations, which brought the ability to store investor’s capital without fear of high volatility of cryptocurrencies.

In this article, I will tell you about the most popular stablecoins – USDC and USDT, as well as their main differences, risks, alternatives and factors to pay attention to when choosing one.

What are stablecoins?

Before we move on to comparing USDC and USDT, let’s first understand the concept of “stablecoin” and its origin.

The expression stablecoin comes from two English words: “stability” and “coin”. Even based on this information, you can understand the developers’ intent: to create a stable coin that would not depend on market sentiment, the level of Bitcoin capitalization and other crypto indicators.

The emergence of “stablecoins” allowed crypto investors to store their capital in cryptocurrency without fear of volatility.

Now let’s talk in more detail about USDT and USDC, compare these market leaders and highlight their main features.

What is USDC (USD Coin)?

The USDC stablecoin was created in 2018 with the support of two large American companies – the cryptocurrency exchange Coinbase and the fintech giant Circle. Together, they formed the Centre consortium – a company that took over the management of USD Coin.

From the very beginning of its existence, Centre has positioned itself as a transparent and trustworthy company regulated by the US authorities. And this is indeed the case. The company undergoes constant audits by independent auditing companies from the Big Four – Grant Thornton, Deloitte, and since 2021 also by SEC.

It is also worth noting that the company’s reserves exceed the number of issued coins, which is mentioned on the company’s website.

The company’s reserves are distributed among various organizations and funds. Most of them are in Circle Reserve Fund, a government fund registered with the SEC. The reserves are stored in cash in large banks and in short-term US Treasury bills.

We have sorted out the collateral for this stablecoin, now let’s talk about the technical component of USDC.

Like many stablecoins, USD Coin does not have its own blockchain. Instead, it uses the Tron, Ethereum, Avalanche, BNB Smart Chain, Solana and many other blockchains. This approach, which distributes the total emission between different blockchains, is more secure than creating and using your own network.

The cost of gas per transaction depends on the blockchain in which USDC is deployed. For example, for USDC transaction in the Ethereum network one will pay higher commission than for the same transaction in the Tron network.

What is USDT (Tether)?

USDT is considered a pioneer among stablecoins. In 2014, the Hong Kong company Tether Limited set itself the task of creating a unique coin that would solve the problem of volatility and convertibility in the crypto market. Thus, USD Tether was created, which marked the beginning of the stablecoin industry.

The token was first listed on the Bitfinex cryptocurrency exchange, where it was used as a pair for various coins on futures and spot trading. Then followed other placements of the token on various cryptocurrency platforms. Now the coin is used by all major crypto platforms.

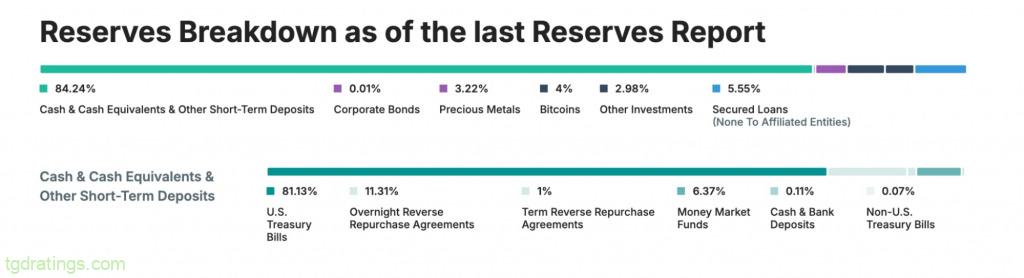

Today, USD Tether is the largest stablecoin by capitalization and total emission. On the official website there are quarterly audit reports from the Italian auditor BDO Italia, last of which, at the time of writing the article, dates back to June 2024. On the website you can also see how the company’s reserves are distributed.

84.24% of reserves are in cash and cash equivalents (US Treasury bills, money market funds, and other assets). Tether Limited has distributed the remaining 15.76% between corporate bonds, precious metals, and Bitcoin. Thus, Tether seeks to maximize the diversification of its reserves.

Like other stablecoins, USDT does not have its own blockchain, although the company had previously considered such an option. Today, USDT is issued on 16 blockchains, with the greatest emphasis on the TRON network ($60 billion), Ethereum ($53 billion), and Avalanche ($1.5 billion).

The cost of fees and the speed of transactions depend on the network in which USDT is deployed. For example, USDT transaction on the Ethereum network will have higher fees than the same one on Tron.

USDC vs USDT: Key Differences

We have analyzed both stablecoins in detail, and now let’s compare them.

Safety and Transparency

USD Coin strives to meet all transparency standards. The company is regularly audited by the world’s largest audit organizations, as stated on the Centre website. USDT also strives for transparency in all processes and undergoes audits. Compared to USD Coin, USD Tether is audited by only one company.

All processes in USDT are tied exclusively to the policy of Tether Limited. They decide how to distribute reserves, when and how many new tokens to issue. USDC is more reliable in this regard due to cooperation with the US authorities and the SEC, as well as audits carried out by many large auditors.

It is also worth mentioning the methods of storing reserves in these two stablecoins. USDT uses a reserve system, where each issued token is backed by one US dollar or another investment asset equivalent. USDC uses a capital control system, where issued coins are backed by dollars in bank accounts. I believe that the second option for storing reserves is more transparent, since it allows for more accurate reporting based on bank information.

Adoption

Both stablecoins have been on the market for quite a long time: USDT since 2014, USDC since 2018. During this time, each of the parties has formed a strong community and a huge number of users. Almost all crypto platforms offer both USDC and USDT. They are most often used to buy/sell other cryptocurrencies or to pay for services.

However, due to the fact that USD Tether appeared earlier, its market capitalization, total emission, and number of users are significantly larger. In the top of the largest cryptocurrencies according to CoinMarketCap, USDT ranks third, only BTC and ETH rank higher, while USDC ranks sixth.

The ways to exchange stablecoins to USD

One can exchanges USDT and USDC stablecoins for USD. A lot of crypto exchanges provides such option, as alternative way one can directly uses swap services of the issuing company. The process of exchanging a stablecoin for traditional fiat currencies requires compliance with certain rules, and each company has its own. For example, if you exchange USDT or USDC using an exchange, you will not encounter any restrictions on the amount. In most cases, the minimum exchange amount on such platforms is approximately equal to 1 US dollar. The situation looks completely different if you make an exchange directly through the issuing company.

So, in order to exchange USDT for USD using Tether, you need to go through the KYC and AML process. It is also worth keeping in mind that the minimum buyback amount is $100 000 . This process is not automated, all applications are processed individually during business hours.

To exchange USDC with Centre services, you also need to go through verification. But compared to USDT, the minimum buyback amount is lower – only 1000 US dollars.

Price

The price of USDT and USDC stablecoins is almost equal to 1 US dollar (usually around 0.9999). However, in the history of both stablecoins, there were cases when the peg to fiat currency was lost for some time.

Depegging Incidents

During their existence, both USDT and USDC have experienced several unpeggings from the US dollar. Most often, such collapses occurred against the backdrop of market panic, negative macroeconomic indicators, or an unstable political situation. The largest unpegging of USDT from the dollar occurred on June 15, 2023, when an imbalance occurred in the Curve liquidity pool. At first, traders accumulated USDT in large quantities, and then suddenly sold everything they had accumulated. Such a sharp change in the balance of power between buyers and sellers led to a drop in the price of USD Tether to $0.0996. Noticing the deviation, Tether immediately returned the coin’s rate to its usual state.

The unpegging of USDC looks much more global than that of USDT. The last one happened on March 10, 2023, when the American Silicon Valley Bank declared bankruptcy. According to various estimates, SVB had about 8% of USDC collateral. The company lost $3.3 billion at one point. At that moment, the value of USDC dropped to $0.92 per coin. Experts predicted that the stablecoin would not be able to recover, but after the intervention of the crypto exchange Coinbase and the contribution of $1.97 billion, the coin still managed to return to its usual value.

Compliance

Currently, the world is actively adopting, legalizing and implementing cryptocurrencies. Therefore, the companies issuing the stablecoins USDC and USDT strive to comply with the requirements of regulatory authorities and comply with the law as much as possible.

However, the company Centre (the issuer of USDC) approaches this more thoroughly than Tether. Centre actively cooperates with various independent auditors, the US Securities and Exchange Commission (SEC) and other regulatory bodies. All reserves and other data of the company are completely transparent, and anyone can view them on the official website of the company.

Tether does not cooperate with regulators as actively as Centre and is audited by only one company.

USDC vs USDT: which stablecoin to choose?

The USD Tether stablecoin has more liquidity and is available on almost all crypto platforms. It is easy to use and is issued on many blockchains. However, there are questions regarding the transparency and authenticity of the reserves.

USDC, on the contrary, has a high level of transparency and security, but cannot boast the same level of capitalization and liquidity. It, like USDT, is available on many platforms and blockchains.

When choosing a stablecoin, it is worth keeping in mind what is more important to you: the availability of the coin or its security. If availability, popularity, and capitalization of the coin are a priority for you – choose USDT. On teh other side, if your priority are transparency and compliance with regulatory requirements – choose USDC.

Risks of using stablecoins

While stablecoins are almost devoid of the main risk of cryptocurrencies – strong volatility, there are several things you should know before using stablecoins. Here are some of them:

- Regulatory risks. Some jurisdictions may impose strict restrictions or bans on the use of stablecoins. This may impact the liquidity and availability of stablecoins, as well as create legal complications for users who use them;

- Credit and counterparty risks. If the issuer does not have sufficient reserves, this may lead to the loss of the peg to the US dollar, which may cause the value of the stablecoin to fall;

- Technical risks and vulnerabilities. Stablecoins operate on blockchain technology, so the risks of hacking a decentralized network apply to stablecoins as well.

Alternatives to USDT and USDC

Besides USDT and USDC, there are other stablecoins worth paying attention to. Let’s take a look at a few of them:

- TrueUSD (TUSD) is a stablecoin pegged to the US dollar, backed by reserves and regularly audited;

- BUSD is a stablecoin from Binance, also pegged to the US dollar, backed by reserves and regularly audited;

- DAI is a decentralized stablecoin pegged to the US dollar and backed by crypto assets through the MakerDAO system.

FAQ