APR vs. APY in Crypto: What’s The Difference?

APR (Annual Percentage Rate) and APY (Annual Percentage Yield) are metrics that help measure the return on investment or the cost of credit (overpayment). In the cryptocurrency market, APR and APY metrics are most commonly used in staking, farming, investment accounts and crypto loans. Understanding the principles of APR and APY helps you pick the most profitable offer among the many financial programs available.

What is APR in cryptocurrency?

APR is a measure of the annualized return on a fixed-rate cryptocurrency investment. It is also used in cryptocurrency lending, allowing you to calculate the overpayment on a loan. APR in cryptocurrency can be compared to a regular bank deposit, where a fixed return for the year is indicated, without compound interest.

APR does not obligate you to place a deposit for exactly one year and can be changed either up or down. The programs offer deposits for one week, month, quarter, six months or a year. The calculation of income in any case is based on the base amount.

How to calculate APR yield?

Most investment platforms offer calculators to quickly calculate the APR yield of an investment. I recommend also calculating the annual percentage rate manually, thanks to which you will better understand the accrual mechanism.

The formula below is used to calculate the annual percentage rate. This formula is also used for crypto-loans, where the total amount is the repayment amount (loan body + interest).

The formula for calculating the final APR yield: A = [P × (1 + R × T)]

Where:

- A = the final payout amount;

- P = initial investment amount;

- R = stated APR rate;

- T = time of deposit (in years).

Example 1:

An investor makes a deposit of 1000 USDT for a period of one year where the APR rate is 10%. Using the formula, we can find out exactly how much total amount he will receive at the end of the term. We check the calculation ourselves using the formula A = [P × (1 + R × T)].

Our calculation is as follows: 1000 USDT × (1 + 0.1 × 1) = 1100 USDT. That is, we will earn 100 usdt in a year.

Explanation:

In the calculation, we convert the APR rate as a percentage to a decimal: 10% → 0.1 (R). We specify the time of deposit as 1 (T), i.e. one year is assumed (base term).

Example 2:

An investor has deposited TRX 1,500 for 6 months in a staking, where the annual interest rate is 12%. To find out the final payout amount, we perform a calculation using the formula: [P × (1 + R × T)] = A.

Our calculation is as follows: 1500 TRX × (1 + 0.12 × 0.5) = 1590 TRX. The total payout at the end of the term will be 1590 TRX.

Explanation:

In the calculation, we convert the APR rate of 12% to a decimal of 0.12 (R). The deposit time (T) here is six months, which is less than the base value (1) by half, so we write down 0.5.

What is APY in cryptocurrency?

APY is a profit accrual or loan payment metric where the calculation is based on previous payments (reinvestment). In this model, the total deposit amount from which interest accrues is increased due to previous payments (compound interest is used). For example, if last month the calculation was made from the amount of 100 USDT and 10 USDT was accrued, this month the calculation will be made from 110 USDT.

For the APY model, the factor of periodicity of payments is important: the more of them, the higher the income at the same rate. Here, as well as in APR, the period of accrual can be daily, monthly, quarterly or yearly.

How to Calculate APY Yield?

Financial platforms indicate the annual percentage yield, but it will be unchanged only if the frequency of interest payments is 1 year. If the recalculation is more frequent, the actual APY rate will change due to an increase in the deposit amount from which the calculation is based. APY, as well as APR, is used to indicate crypto loan overpayments.

The process of calculating the total profit on APY is divided into two steps: first, we find the actual interest rate with reinvestment, and then the total amount of payment at the end of the term. If the actual APY rate (taking into account reinvestment with payments) is already specified in the program, it is not necessary to look for it, and you can go straight to calculating the total profit (loan payment).

Calculation of actual interest (taking reinvestment into account)

When choosing a cryptocurrency investment program, the APY is often stated without taking into account the number of payouts. To find the exact percentage of APY, where reinvestment periods are taken into account, you need to make a calculation using the formula: A = (1 + r/n)n – 1.

The formula for calculating the actual APY percentage taking into account reinvestment periods: A = (1 + r/n)n – 1

Where:

- A = interest, including recalculation;

- r = stated interest rate APY;

- n = number of recalculation periods (payments).

Example 1:

Investing 100 ETH at an APY rate of 24% with a payout period every 6 months, let’s calculate what the actual interest will end up being.

Our calculation is as follows: (1 + 0.24/2)2 – 1 = 0.2544 (25.44%). The actual interest including payments will be 25.44%.

Explanation:

We write the APY 24% interest rate stated in the program as a fraction (0.24) in the numerator (r) and the number of repricings per year (2) in the denominator (n). We then calculate using the formula and get the interest including reinvestment: 0.2544 → 25.44%.

Example 2:

Investing 100 ETH at an APY rate of 24%, with monthly recalculations, let’s find the actual interest.

Our calculation is as follows: (1 + 0.24/12)12 – 1 = 0.2682 (26.82%). The actual interest including payments will be 26.82%.

Explanation:

We write the stated interest rate APY 24% as a fraction (0.24) in the numerator (r) and in the denominator (n) the number of interest payments over a period of 12. Then we use the formula and get the interest including reinvestment 0.2682 → 26.82%.

Calculating the final amount of income by APY

Above we have seen how to calculate the actual interest including reinvestment, and now we will calculate the final amount of payment.

The formula for calculating the final amount of income from investments under APY (the sum of the initial deposit + profit): X = P × A + P

Where:

- X = the final payout amount at the end of the term;

- P = initial deposit amount;

- A = interest including recalculations.

Example 1:

Investing 100 ETH and knowing the actual APY rate of 25.44% (including payout periods), we can calculate the final payout amount at the end of the term.

Our calculation is as follows: 100 × 0.2544 + 100 = 125.44 ETH.

The total payout at the end of the term, taking into account the floating rate APY, will be 125.44 ETH.

Example 2:

Investing 100 ETH and knowing the actual APY rate of 26.82% (taking into account the payout periods), we can calculate the final payout amount at the end of the term.

Our calculation is as follows: 100 × 0.2682 + 100 = 126.82 ETH. The total payout at the end of the term, taking into account the floating rate APY, will be 126.82 ETH.

Difference between APR and APY

The difference between APR and APY is only in the method of interest accrual. While APR uses a fixed rate, APY uses compound interest, where compounding takes place. With the same initial investment amount, the return under APY will be higher than under APR. How much higher will depend on the number of recalculations during the deposit period. It is better for an investor to consider programs with the APY method of calculation, and for a borrower – with APR.

Table comparing APR and APY

| APR | APY |

|---|---|

| Simple calculation principle due to the absence of compound interest; | Calculation method where compound interest is applied; |

| Calculation is made from the initial amount of the deposit; | Calculation is made from the last amount, taking into account previously accrued payments (after reinvestment); |

| Preferred for loans; | Preferred for investments; |

| Fixed yield. | Flexible accrual system. |

How are APR and APY used in cryptocurrency?

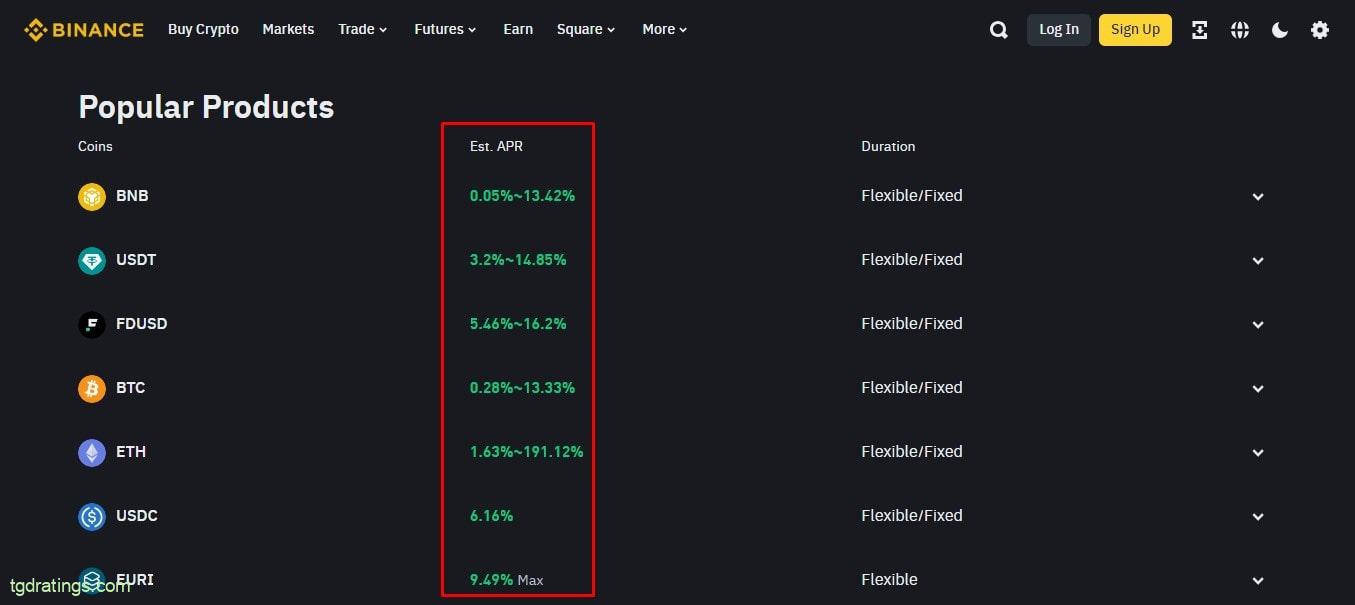

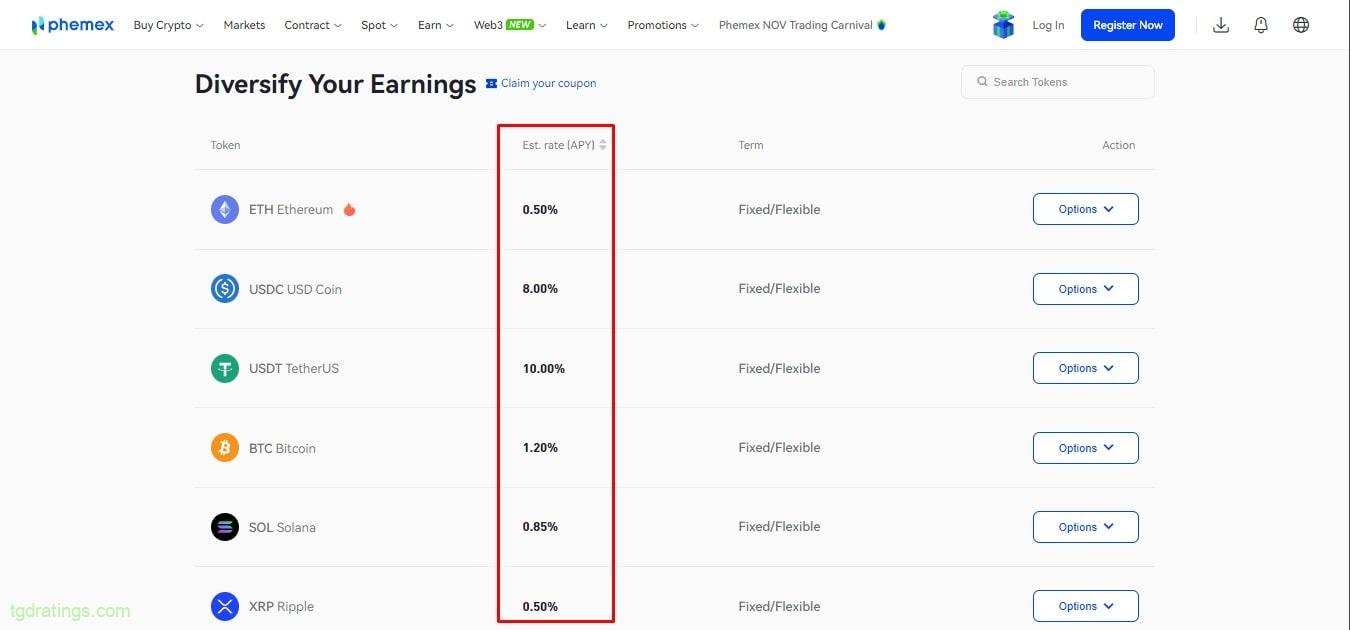

APR and APY metrics in cryptocurrency are mainly used in DeFi products and centralized exchanges (CEX), where income percentages are specified for savings accounts, staking, farming, crypto-loans, etc. Annual Percentage Rate is most often specified for fixed-term deposit or loan offerings. APY is used for programs with flexible deposit or loan terms.

Often sites can apply a marketing move, showing on bright banners a high percentage of income of investment programs. A detailed examination of the product may reveal that the terms are not quite as favorable as they may seem at first glance. Often high yields are offered for high-risk coins.

APR vs APY: what is better for investors?

The goal of investment is to get the maximum profit from the invested funds. The highest yield for the same amount will show APY, especially if the recalculation is done daily or weekly. But investors and crypto borrowers can not always choose the method of calculation. In most cases, only one metric is specified on one platform.

Conclusion

APR and APY are a measure of return on investment or loan overpayment. With the help of these metrics, you can easily calculate the future return on investment or loan overpayment. APR and APY in the cryptocurrency sphere are used on almost all DeFi services, as well as in the investment offerings of crypto exchanges. The main difference between APR and APY lies in the interest accrual methodology. The first variant uses a fixed rate, while the second variant uses compound interest. Thus, annualized interest rate will be a better option for loans, while annual percentage yield is preferable for investments.

Frequently Asked Questions