What is cryptocurrency staking

Staking is a way to earn cryptocurrency by locking up assets in Proof-of-Stake (PoS) consensus networks.

Staking works similarly to traditional bank accounts. Banks pay interest on using funds for loans and other investments. With staking, escrowed coins are used to verify transactions on the blockchain and manage the network. In return, token holders receive a reward depending on the stake amount.

TOP 5 exchanges for staking cryptocurrencies

When looking for the best staking platforms, we focused on a certain set of criteria: yield, blocking conditions, and number of tokens supported. The review of staking platforms you can find below.

1. Binance

Site URL: https://www.binance.com/en/staking

- Binance is the world’s largest exchange in terms of cryptocurrency trading volume;

- Binance offers two types of staking: fixed staking and DeFi staking (flexible);

- Fixed staking is a blocking of coins for a set period;

- Interest is distributed daily from the day following the start of staking until the end of the relevant product period. You can choose to close early: after that, the principal amount will be returned to the spot account, and the distributed interest will be debited from the returned principal amount;

- Binance fixed staking period: 7 to 120 days;

- More than 110 cryptocurrencies (BNB, DOT, SOL, MATIC, etc.) available for Binance Fixed Staking;

- Flexible blocking periods are typical of DeFi staking. This is where investing in third-party projects takes place;

- DeFi projects provide higher returns in certain currencies;

- The main benefit of DeFi staking is that you don’t need to maintain a network wallet for every project you stake on. In addition, there are extremely short betting periods (24 hours);

- 60+ cryptocurrencies available on Binance DeFi staking;

- DeFi staking rewards are calculated starting the next day of staking. The minimum profit calculation period is one day. Income received for a period of less than one day is not taken into account in the distribution;

- The blocking period for DeFi products is 1 day. The funds will be unlocked and returned to the user’s account the next day. The blocking period is indicated in the product information;

- If you find it difficult to understand the Binance platform, you can use the official Binance crypto wallet – Trust Wallet, and place bets from it.

2. OKX

Site URL: https://www.okx.com/earn/product/staking

- Okx.earn offers users several types of earnings: savings, staking, double investment (BTC-USDT or ETH-USDT), earnings on stablecoins, DeFi, etc.;

- Interest begins to accrue at 00:00 on the day following the subscription;

- If you cancel your fixed-term subscription before it expires, the system will deduct all revenue;

- 46 coins available for staking.

3. Huobi

Site URL: https://www.huobi.com/en-us/staking/vote/

- Huobi Global allows you to participate in Proof-of-Stake (PoS) protocols while earning passive income. However, since the threshold for participation in DeFi products can often be high, Huobi Global is committed to lower barriers to entry;

- Holders of a small amount of tokens tend to be less likely to be selected for DeFi staking and therefore less likely to receive rewards. To increase their chances, token holders often gather their resources together and create pools, which allows them to reward in proportion to their contribution to the pool;

- Huobi Global betting product is easy to use. You don’t need to manage private keys, sign transactions, find nodes, perform other tasks, or have certain qualifications to participate in staking. With Huobi Global, you can stake your tokens in a couple of clicks;

- The exchange carefully selects reliable staking projects and monitors their systems in real time to ensure the process runs smoothly;

- 14 coins available for staking: TRX, ADA, AVAX, SOL and more.

4. BitGlobal

Site URL: https://www.bitglobal.com/en-us/investment-finance

- BG Staking includes two types of projects: supporting long-term repayment and non-supporting early repayment. Projects that support early reward allow users to redeem blocked funds and receive related rewards during the blocking period. Projects that do not support early reward cannot be unlocked until the lock period ends;

- For projects that support early repayment, the actual reward rate is lower than the agreed rate if the funds are redeemed in advance because the agreed rate is valid for the entire lock period;

- For projects without prepayment bids will be frozen and cannot be sold or withdrawn during the lock-up period;

- Rewards for projects without early redemption will not be credited to the user’s account until the end of the lock period or a successful early redemption.

5. Kraken

Site URL: https://www.kraken.com/features/staking-coins/

- Kraken offers fiat currency staking rewards such as Euros and USD;

- The exchange offers flexible and fixed staking;

- 15 coins available for staking, including Cardano (ADA), Cosmos (ATOM) Ethereum 2.0 (ETH2), Flow (FLOW), DOT (Polkadot) and more;

- Benefits of betting on the Kraken: instant rewards – no waiting or lock-up periods, the highest fixed income in the industry, payouts twice a week and more;

- Staking is available in the Kraken Pro mobile app;

- The annual yield varies by coin and ranges from 0.25% to 20%;

- Unlike other staking services, the reward is already accrued minutes after the funds are deposited. Payouts occur twice a week – every Monday and Thursday at 14:00 UTC.

How cryptocurrency staking works

Staking works the following way: user blocks a certain number of coins in the wallet, thereby participating in the maintenance of the blockchain, and receives a reward for this.

To start staking, you need a cryptocurrency that runs on the Proof-Of-Stake consensus algorithm. Popular staking coins include Ethereum, Solana and Cardano. If you do not have cryptocurrencies suitable for staking, you can purchase them on popular cryptocurrency exchanges.

Types of crypto staking

There are the following types of cryptocurrency staking:

- Flexible: shorter time frames are assumed. The maximum blocking period is seven days;

- Fixed (blocked): follows strict rules. The minimum staking period is typically 15-30 days and the maximum is 90-120 days. The user will not have access to their funds until the lockout is completed during this period;

- DeFi: focuses on DeFi protocols. DeFi staking differs from the usual one in that third parties participate in the process (organizations or individual users who take coins from the owner at interest, that is, they are credited). DeFi staking attracts users with quick withdrawals, higher returns, guaranteed payouts.

How to stake cryptocurrency on Binance

To start staking cryptocurrencies, user must decide on which platform and which coins he plans to stake. Let’s take a closer look at this process using the example of the exchange Binance.

To stake cryptocurrency on Binance:

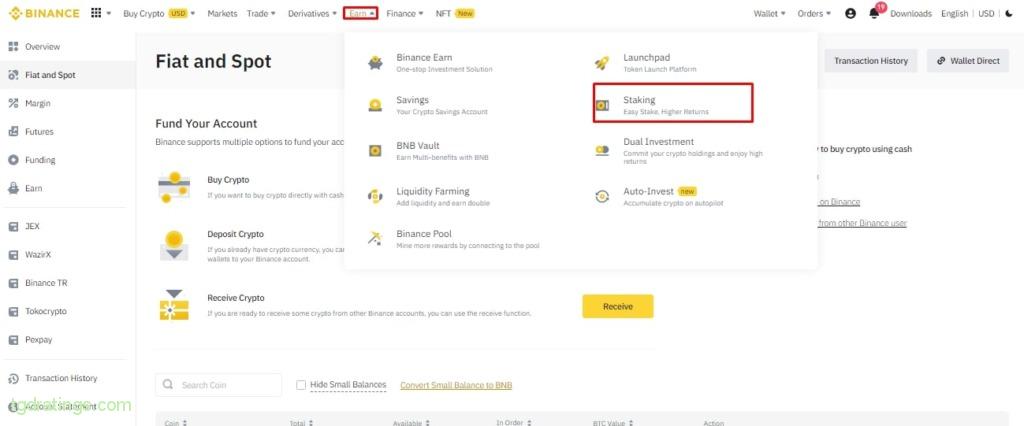

- Go to your personal account on the exchange and select the Earn → Staking tab;

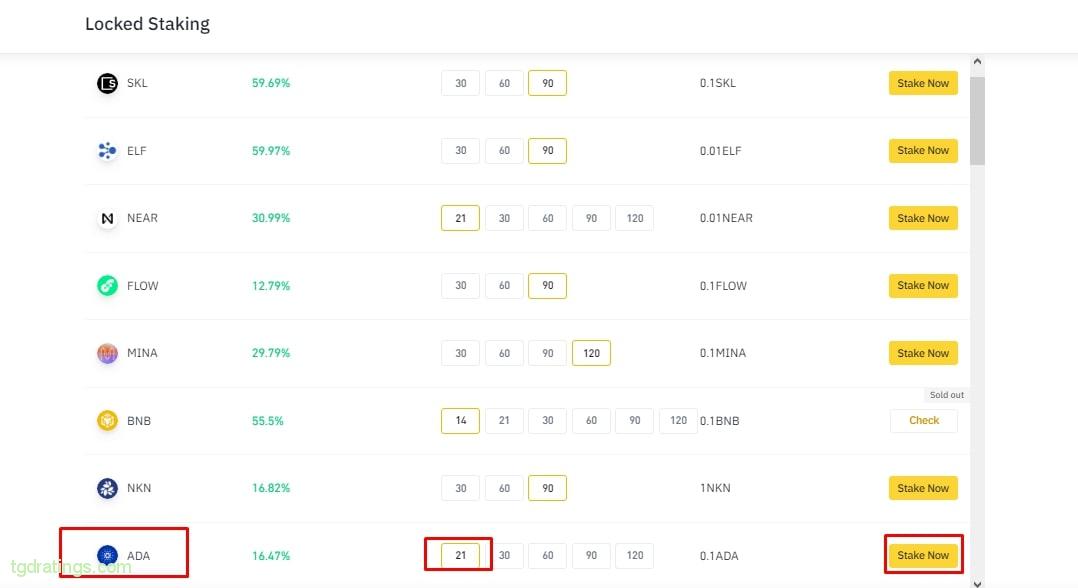

Starting Binance staking - Select coin to stake such as ADA and click Stake Now;

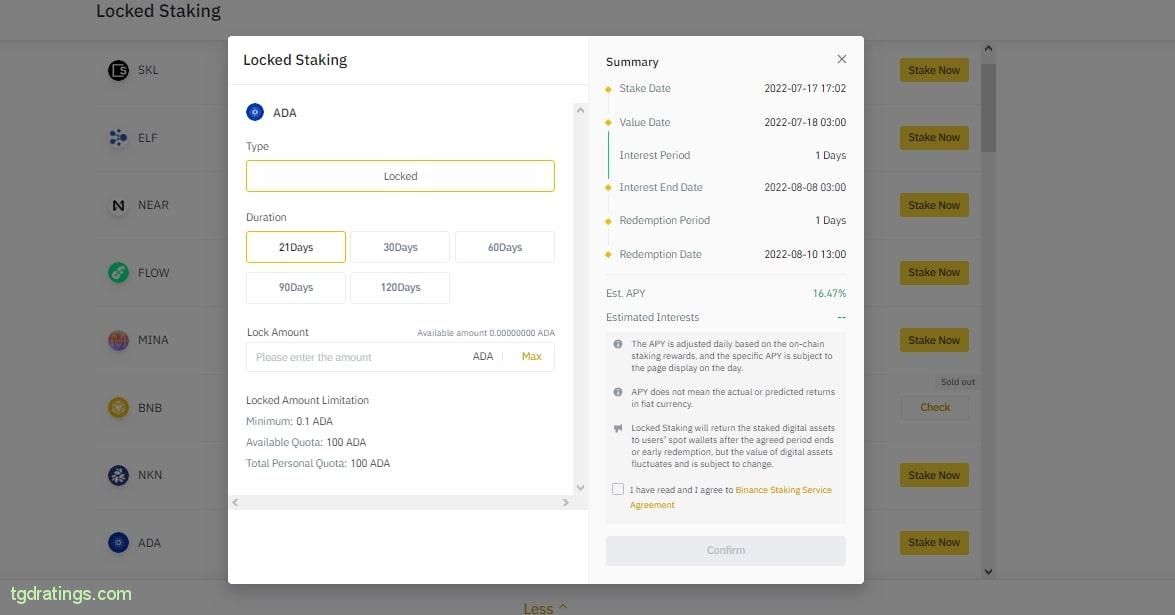

Selecting a staking coin - Select coin lock duration, enter number of coins, click check box “I have read and I agree to Binance Staking Service Agreement” and then click Confirm.

Staking ADA on Binance

Percentage of profitability is displayed in green next to each token. After adding assets, the system blocks the specified amount, and for the duration of the hold, it is not displayed in the spot wallet. The reward is calculated daily. You can choose to close the contract early, but then the user will not receive the previously accrued interest.

Why not all cryptocurrencies are available for staking

Staking is used for cryptocurrencies that use the Proof-of-Stake consensus mechanism. Some of these coins are: Cardano (ADA), Solana (SOL), Luna (LUNA), Avalanche (AVAX), Polkadot (DOT).

Best cryptocurrencies to stake

The profitability of staking depends on the cryptocurrency. Popular coins are more reliable, but bring less income, compared to lesser known coins.

1. Polkadot (DOT)

- DOT is the native token of the Polkadot network. DOT can be used to pay transaction fees, stakes, management, purchase a parachain slot, etc.;

- Polkadot is a next-generation blockchain protocol that allows multiple blockchain ecosystems to interoperate. It provides interoperability between various purpose-built blockchains by merging them;

- Block period: 30 to 120 days;

- Yearly return: from 11% to 20%, depending on the site and time of staking.

2. Tezos (XTZ)

- XTZ is the native token of the Tezos blockchain. It is used to interact with dApps, pay fees, secure the network through staking and more;

- Tezos is a self-regulating decentralized platform for building dApps. It is similar to Ethereum in that both blockchains support dApps built using smart contracts;

- Block period: 30-90 days;

- Yearly return: 7.12% to 10.25%, depending on the site and time of staking.

3. Binance Coin (BNB)

- BNB is the native token of the largest cryptocurrency exchange Binance. The token was created on the Ethereum network and has the ERC-20 standard. The coin can be used to pay commissions when trading on the Binance exchange, pay for goods and services, etc.;

- Block period: 14 to 120 days on Binance;

- Yearly return: from 12.9% to 55.5%, depending on the platform and time of staking.

4. Polygon (MATIC)

- MATIC is Polygon’s native token. It is used to manage and secure the network by staking. The coin allows users to interact with hundreds of decentralized applications participating in the Polygon ecosystem;

- Polygon is a decentralized Ethereum scaling platform that allows developers to create low-fee dApps without sacrificing security;

- Staking requires at least two coins;

- You can start staking by connecting your MetaMask wallet to your Polygon wallet;

- Block period: from 30-90 days;

- Yearly return: from 8.97% to 21.54%, depending on the platform and time of staking.

5. Algorand (ALGO)

- ALGO is the base token of the Algorand network, used to receive returns on investments and participate in network management;

- Algorand is a blockchain-based decentralized network that supports smart contracts and multiple applications. The project aims to create a borderless economy using blockchain. The Algorand network is secure, scalable and cost effective;

- It is enough to have one ALGO coin to become a validator;

- With ALGO, you can start the staking process using the Ledger or Coinbase wallets;

- Block period: 30-120 days;

- Yearly return: from 2.25% to 8.24%, depending on the platform and time of staking.

6. Solana (SOL)

- SOL is natibe cryptocurrency of the Solana blockchain. It is burned to pay fees on the network. SOL can also be staked to become a blockchain node;

- Solana is a highly functional open source project that solves the problems of decentralization, security and scalability. The network is characterized by low fees and fast transactions (in just a few seconds);

- You can stake SOL with Ledger, MathWallet, Atomic Wallet and Exodus Wallet;

- Block period: 30-90 days;

- Yearly return: from 6.48% to 14.79%, depending on the platform and time of staking.

7. PancakeSwap (CAKE)

- CAKE is the govern and reward token of the PancakeSwap decentralized exchange. CAKE holders can vote on platform management decisions, have discounts on perpetual futures trading fees, access IFOs, buy lottery tickets, etc;

- PancaeSwap is a decentralized exchange (DEX) on the BSC network that uses an automated marketmaker mechanism to facilitate the exchange of tokens;

- In order to place a CAKE bet, you first need to connect your wallet to the PancakeSwap platform. Supported wallets: MetaMask, Trust Wallet, MathWallet, TokenPocket and Binance Chain Wallet;

- Compared to platforms like Ethereum, fees for transactions on Binance Smart Chain are significantly lower. Once you receive a reward on PancakeSwap, you can either collect it or reinvest in the platform;

- Block period: 30-120 days;

- Yearly return: from 8.79 to 79.87%, depending on the platform and time of staking.

8. SushiSwap (SUSHI)

- SUSHI is the service token of the SushiSwap decentralized exchange. It can be used for staking and earning rewards within the DEX protocol. This is a govern token too, meaning its holders have a proportional number of votes based on the amount they own;

- SushiSwap is an Ethereum-based decentralized exchange (DEX) that allows users to swap tokens, earn crop rewards, and more;

- Block period: 15-90 days;

- Yearly return: from 6.7% to 13.9%, depending on the platform and time of staking.

9. Cardano (ADA)

- ADA is the native cryptocurrency of the Cardano network, which is used for payment of commissions, transactions, staking;

- Cardano is a blockchain platform based on peer-reviewed research. The Cardano network can process several hundred transactions per second;

- Official wallets: Yoroi and Daedalus;

- Block period: 30-120 days;

- Yearly return: from 4.86% to 15.79%, depending on the platform and time of staking.

10. Avalanche (AVAX)

- Avalanche (AVAX) is the native token of the Avalanche network, used for fee payments, staking, as the base unit of account across multiple subnets deployed in Avalanche;

- Avalanche is an open source blockchain designed for decentralized application development and enterprise use. The developers claim that the blockchain provides scalability, speed and the ability to communicate and work with other blockchains;

- AVAX is able to scale to millions of different validators;

- You can place your AVAX coins on various wallets: Ledger, MetaMask and Avalanche Wallet and others;

- Block period: 30-120 days;

- Yearly return: from 8.99% to 29.75%, depending on the platform and time of staking.

Passive income from staking cryptocurrencies

Staking rewards vary depending on the platform, cryptocurrency and the number of users who stake a given coin:

- Coin: Popular coins such as Ethereum, Cardano and Polkadot can have rewards ranging from 5% to 20%. With lesser known cryptocurrencies, these rewards can even be above 100%;

- Platform: The reward rate may vary depending on the platform. There are platforms that offer fixed income for a specific lock-up period, while others adjust conditions daily;

- Number of users who staked a coin: Staking returns may vary depending on how many people participate and what the total reward pool is, as the amount of capital that participates in placement or lending changes. The more people lending, the lower the reward and vice versa. Some of the highest staking rewards at the moment can be found on Binance, Kraken and other exchanges.

Risks and recommendations for newbies on staking

Cryptocurrency staking has become a popular way to generate investment income in the crypto market. However, like all types of investment, it is risky:

- Market risk: Cryptocurrency prices are volatile, which means that it can depreciate quickly. In the event that assets fall by a significant amount, the interest from staking may not cover the loss. Therefore, crypto investors need to carefully choose the assets they decide to stake;

- Block periods: while staking, you will not be able to access your cryptocurrency for a certain period of time;

- Lost or theft: If the user does not pay attention to security, there is a possibility of losing the private keys of their wallet, as a result of which access to the funds will be lost. Therefore, it is important to back up your wallet, take care of additional security measures such as 2FA.

Pros and cons of staking

FAQ

Before choosing an exchange, you need to familiarize yourself with the conditions and technical aspects of the site in detail to make sure that the reward balances the potential risks.

Comments (0)