10 Best Mining Pools in 2025

The difficulty of mining Bitcoin is rising and a lot of miners deciding to join mining pools. This increases the chances of pool members to find a new block before others and receive a part of the reward. There is also no need to spend money on additional power to mine profitably. More than this mining pools help to reduce competition between miners and increase the chances of getting profit per block.

Tgdratings.com experts have presented the ranking of the best mining pools in 2025 year.

TOP 10 mining pools

The pools listed below provide high hashrates and has a good reputation among users.

1. Binance Pool

Address: https://pool.binance.com/

Binance Pool is a fast-growing pool owned by Binance – the largest crypto exchange in terms of trading turnover. This is a high-tech and secure platform that is actively expanding its presence in the field of mining.

The pool has 700+ thousand active miners. Available cryptocurrencies for mining: Bitcoin, Bitcoin Cash, Litecoin, Ethereum, Ethereum Classic, Zcash, etc.

The main supported algorithm for mining BTC and BCH is SHA256. To work with the pool, identity verification is required. Rewards are distributed every 24 hours. Customers with high hashrate can apply for VIP-status to enjoy special privileges.

Main features

Basic information about the BTC pool:

- Hashrate: 51.55 EH/s;

- Payment threshold: none;

- Reward distribution method: FPPS;

- Fees: 2.5%.

Pros and cons

2. ViaBTC

Address: https://www.viabtc.com/

ViaBTC is a mining pool that was launched in China in 2016. The operator services 600+ thousand miners located in 130+ countries. Has a good reputation among users. Supports BTC, BCH, BSV, FCH, ETH, ETC mining.

The platform offers a mining pool, ViaBTC wallet, access to the CoinEx and Smart Chain exchanges, as well as access to the OneSwap decentralized exchange. In addition to the extensive ecosystem, unique features are available to improve your mining efficiency. These include smart mining and one-click switch option. The main Bitcoin mining algorithm is SHA256d.

Main features

Basic information about the BTC pool:

- Hashrate: 25.10 EH/s;

- Payout threshold: 0.001 BTC;

- Reward distribution method: PPLNS, PPS+, Solo;

- Fees: 4% for PPS+, 2% for PPLNS, 1% for Solo.

Pros and cons

3. BTC.com

Address: https://pool.btc.com/

The BTC.com team is focused on providing users with an easy-to-use multi-currency mining platform. In addition to BTC, users can mine BCH, LTC, ETH, DCR, CKR. The company was founded in 2015 as a blockchain explorer and launched a Bitcoin mining pool a year later.

The pool is available in 10+ languages, including Spanish, Russian, French, Japanese and others. The platform has open source code.

Main features

Basic information about the BTC pool:

- Hashrate: 9.358 EH/s;

- Payout threshold: 0.005 BTC;

- Reward distribution method: FPPS;

- Fees: 4%.

Pros and cons

4. TrustPool

Address: https://trustpool.cc/

Trustpool is a mining platform operating since 2019. It supports mining of 5 popular coins (BTC, LTC/DOGE, BCH, DASH) using SHA-256d, Scrypt, X11 algorithms. The key difference from competitors is low mining fees.

Additional services on the platform include a profitability calculator, a hashrate converter and a halving calendar.

Main features

Basic information about the BTC pool:

- Hashrate: 8.017 EH/s;

- Payout threshold: 0.001 BTC;

- Reward distribution method: PPS+;

- Fees: 1%.

Pros and cons

5. Luxor

Address: https://luxor.tech/

Luxor is the USA platform for mining and blockchain analytics. Operating since 2017. Supports mining of BTC, ZEC, ZEN, SC, LTC+DOGE using SHA-256, Equihash, Scrypt, Blake2b-Sia algorithms.

For most and cryptocurrencies, the platform charges a 3% fees (for BTC the fee is lower), which is the industry average. At the same time, Luxor pools are distinguished by high and stable hashrate. Additional features include an own platform for trading derivatives on BTC, mining software and analytical platform.

Main features

Basic information about the BTC pool:

- Hashrate: 20.798 EH/s;

- Payout threshold: 0.001 BTC;

- Reward distribution method: FPPS;

- Fees: 2.5%.

Pros and cons

6. EMCD

Address: https://emcd.io/

EMCD is a mining pool and ecosystem operating since 2019. As of 2023, the service was used by more than 200 thousand users around the world. The platform supports mining BTC, LTC/DOGE, ETC, BCH, DASH, KAS using the SHA-256, Scrypt, X11, Etchash and kHeavyHash algorithms.

EMCD offers several unique options, including fixed commission rates for mining, the possibility of additional earnings for storing mined cryptocurrency within the ecosystem, and its own P2P-service with support for 4 national currencies.

Main features

Basic information about the BTC pool:

- Hashrate: 15.42 EH/s;

- Payout threshold: 0.0001 BTC;

- Reward distribution method: FPPS;

- Fees: 1.5%.

7. Poolin

Address: https://www.poolin.com/

Poolin is one of the youngest mining pools. The platform was launched in 2018 and quickly became one of the top leaders in terms of hashrate. The number of active miners is 56+ thousand.

Similar to F2Pool, Poolin offers a pooled mining feature that allows users to mine multiple cryptocurrencies using the same computing power. Poolin also offers an auto-switching feature that switches the hashrate between BTC and BCH, depending on which coin can provide the most mining profitability at the time.

Main features

Basic information about the BTC pool:

- Hashrate: 5.07 EH/s;

- Payout threshold: 0.005 BTC;

- Reward distribution method: FPPS;

- Fees: 2.5%.

Pros and cons

8. F2Pool

Address: https://www.f2pool.com/

F2Pool is one of the best Bitcoin mining pools. It was launched in China in 2013 and was known as Discus Fish. Today, the service operates in 100+ countries. The platform is available in English, Spanish, Chinese and Ukrainian.

The pool has 2+ million miners around the world. The SHA256d algorithm is used for mining BTC. You can also mine ETH, LTC, ETC, BCH, CKB, RVN, ZEC, ZEN, KDA, DCR, DASH, etc. Some of the coins can be mined through pooled mining. This means that users can earn additional coins without increasing their hashrate.

Main features

Basic information about the BTC pool:

- Hashrate: 42.62 EH/s;

- Payout threshold: 0.005/0.01/0.05/1/5 BTC;

- Reward distribution method: PPS+;

- Fees: 2.5%.

Pros and cons

9. Slush Pool (Braiins Pool)

Address: https://slushpool.com/en/home/

Braiins Pool is the first Bitcoin mining pool in the world. Launched in 2010 under the name Slush Pool. The pool was initially managed by members of Satoshi Labs (creators of the Trezor wallet), but is now run by Braiins company. The number of active miners is 95+ thousand.

The platform publishes mining data through statistical evidence, that’s why Braiins Pool is known for its stability and accuracy. It is often considered one of the most transparent mining platforms. The user interface is friendly for novice miners. Newcomers may try mining using the demo version. The platform supports multiple languages, including English, Russian, Spanish, Farsi and Chinese. Mobile applications also available.

Main features

Basic information about the BTC pool:

- Hashrate: 6.99 EH/S;

- Payout threshold: 0.001 BTC;

- Reward distribution method: Score;

- Fees: 2%.

Pros and cons

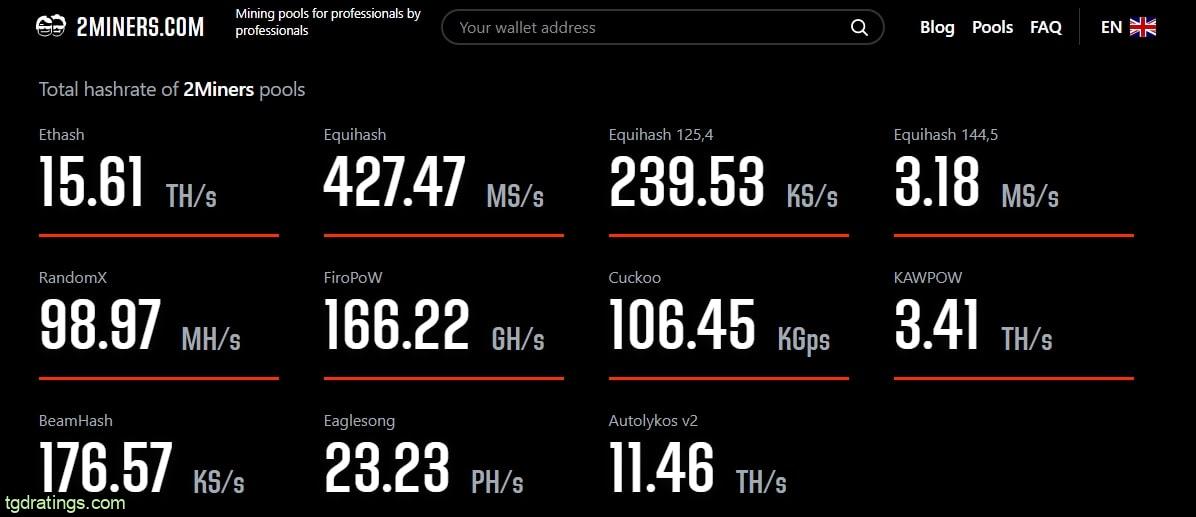

10. 2miners

Address: https://2miners.com/

2 Miners is an easy to use multi-currency mining pool with servers in Europe, USA and Asia. 2Miners allows users to mine 20+ cryptocurrencies, including Ethereum, Ethereum Classic, Bitcoin Gold, Zcash, etc.

The pool supports 18 languages (Spanish, Polish, Russian, etc.), two mining modes, payments within 24 hours. The number of active miners is 48+ thousand. You can receive notifications about new blocks via telegram bot and by e-mail. The pool commission is: 1% for PPLNS and 1.5% for SOLO.

Main features

Basic information about the ETH Classic pool:

- Hashrate: 12.28 TH/s;

- Payout threshold: 0.1 ETC;

- Reward distribution method: PPLNS, SOLO;

- Fees: 1%.

Pros and cons

What are the different types of mining pools?

According to the payout system, there are more than 15 types of mining pools. However, the vast majority of pools are based on PPS, PPLNS, PPS+ and FPPS. Let’s consider them in more detail:

- Per Share (PPS) or pay per share: guarantees the miner a payout regardless of whether the pool finds the next block. The cost of a share is determined by the network complexity, block reward, block time and pool power. This method is rarely used by large pools due to high fees;

- Pay-Per-Last N Share (PPLNS) or Last N Share Fee: distributes profits based on the number of shares contributed by pool members. Miners are rewarded only after a block has been found. Unlike the first payout model, there are significant profit fluctuations here. For example, if a pool mines several blocks per day, its members will receive a significant profit. If a mining pool does not find a single block during the day, its members do not earn anything. Pools that use Pay-Per-Last N Share may or may not include transaction fees in miner payouts. This model is more commonly used by large pools;

- Pay-Per-Share Plus (PPS+) Pay Per Share Plus: combines PPS and PPLNS. Block rewards are in line with the relatively stable PPS payment model, and transaction fees are in line with the PPLNS regime. Mining rewards are constant, but transaction fee calculations vary greatly;

- Full Pay-Per-Share (FPPS): The mining pool pays miners the expected block reward. Members also receive transaction fees. This is an improvement to the Pay-Per-Share system. Payments are calculated using theoretical concepts of rewards and transaction fees. For example, pool operators calculate a standard transaction fee in the short term and distribute it among the miners according to their share.

Less common payment systems:

- Proportional method (PROP) distributes the reward proportionally among all miners, depending on the number of shares that each of them owns;

- The Total Max Pay-Per-Share (SMPPS) method is similar to the Pay-Per-Share (PPS) approach, but has the limitation of not paying more than the mining pool profit.

How to choose the best mining pool?

To select a mining pool, examine company reviews and their reputation, pool statistics, commissions, pool size, reward distribution methods, etc.

Reputation

Reputation is one of the important factors when choosing a pool. Unfortunately, not all mining pools work honestly. Some overestimate commissions and do not pay rewards properly. Among the obvious signs of fraud lets highlight:

- Profit guaranteed: Profit-guaranteed pools may promise more than they can deliver;

- Company anonymity: Mining pools or services owned and operated by anonymous companies or individuals can sometimes be fraudulent;

- No public audit data: Mining pools or mining services that do not publish data about their operations or do not disclose hash rate statistics can be fraudulent;

- No hash rate proof: Legitimate pools provide hash rate statistics that cannot be faked and can be independently verified by any would-be miner. Fraud companies do not provide such statistics or publish their hash rate figures without any supporting evidence.

To avoid scam pools, you need to chech up the reviews or visit the forums to get a better idea about the service you may want to join to. You can find positive and negative reviews about any company, but too large number of bad review is an alarm sign when choosing a pool.

Commissions

The pools charge miners a commission on each reward, thereby covering the costs of equipment, internet and administration costs. Typically, the pool fee is between 1% and 5%. In order to keep track of your rewards, it is important to know how much commission the pool is charging.

Pool Size

The size of the pool and the market share it holds plays a big role in mining. Large pools include more users: combining their hash power, the speed of mining a new block becomes even faster. This multiplies the chances of one of the participants to find the next block. The reward is shared among all miners. Therefore, it is better to join a large pool in order to receive faster and more stable income.

Pool efficiency

Mining efficiency is the ratio of confirmed and rejected transactions. You can calculate it using the formula accepted/(accepted+rejected). It’s important to aim for 100% efficiency, as any lower number means lower stability and profitability.

Remuneration distribution method

The reward system is one of the main characteristics of a mining pool and can be a key factor in choosing it. Different bitcoin mining pools have their own reward distribution methods. There are more than 15 in total, but PPS, PPLNS, PPS+ and FPPS are the most commonly used.

FPPS is the most risky for the pool operator, so there is usually a higher fee. PPLNS pools has a little or no risk to the pool operator, so they can have very low fees.

Geographic location

If two miners find the correct solution for the current block at the same time, then the one who submits the solution first is more likely to receive the reward. Therefore, it is recommended to choose a pool close to you in order to have the best internet connection quality.

Support

It is important to choose a pool that has 24/7 support. This will allow you to quickly resolve possible problems.

Why are crypto miners important?

Miners do the job of verifying the legitimacy of bitcoin transactions. By verifying transactions, they help prevent the “double spending problem”.

What are pros and cons of mining pools?

FAQ

Unlike pools, cloud mining allows you to mine cryptocurrencies using a remote data center with a shared computing power. In simple it is mining on rented equipment. The user needs to register in the cloud mining service and purchase a mining contract by paying a fee.

Crypto mining from home is still an option for other popular cryptocurrencies such as Dogecoin and Ethereum Classic etc.

Before you start mining, calculate your potential profit with crypto mining profit calculator, which is easy to find on the Internet.

Conclusions

Mining pools are groups of crypto miners that combine computing power to create new blocks and receive rewards. The pools divide the payout among all participants depending on the contribution of each. Miners have to pay a fee to the pool.

Mining pools provide an opportunity for private miners who do not have access to large computing power to receive a stable reward. However, before joining any pool, it is recommended to carefully study security measures, reputation, fees, hashrate and other pool statistics. It is also important to read customer reviews on a particular pool.